Bitcoin’s Recent Spike: A Closer Look

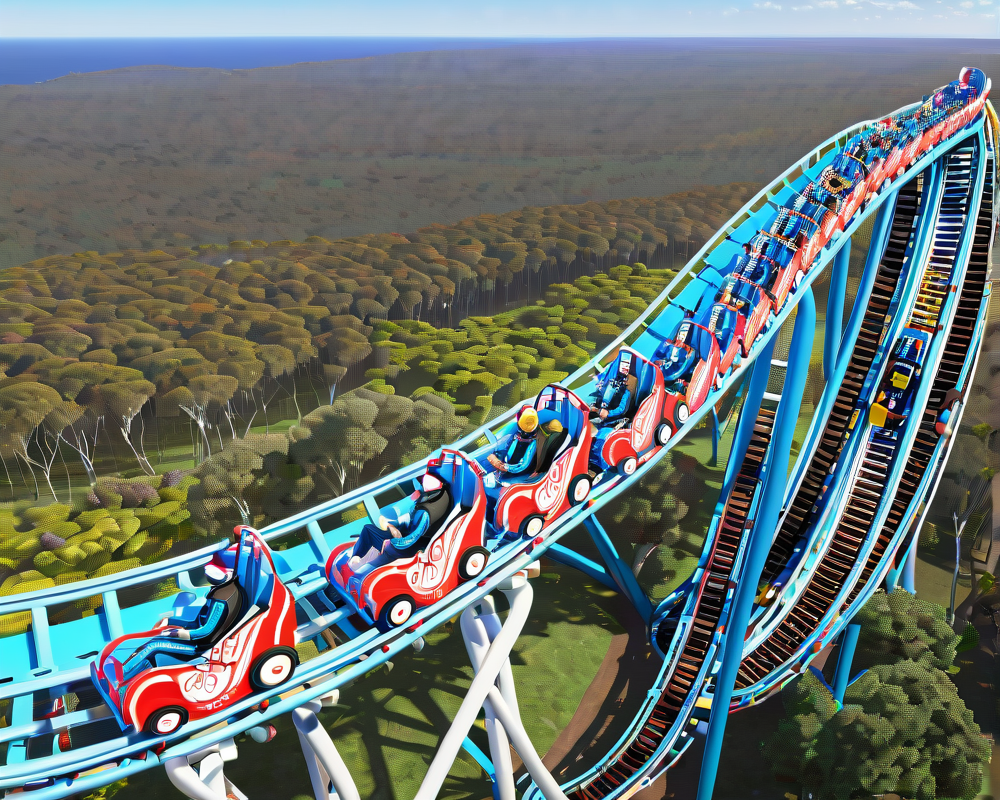

Over the past 24 hours, Bitcoin (BTC) has experienced a modest increase of 3%, rising from $10,322 to $10,680. However, traders and enthusiasts are raising eyebrows as BTC lingers near a substantial resistance level of $11,000. Could this be a case of the tortoise versus the hare? Well, buckle up because the crypto rollercoaster is just getting started!

Resistance: The Roadblock Ahead

Despite a recent elevation above the sagging support of $10,570, Bitcoin is facing a sizable wall of resistance from $11,000 up to $11,288. This range is more formidable than your Aunt Karen at the all-you-can-eat buffet. Past attempts to push higher have proven unsuccessful, leaving many to wonder if we’re in for a consolidation phase or a full-blown rally.

The Lowdown on Volatility: What Gives?

Bitcoin’s futures market is coughing up open interest, plummeting from $5.7 billion to $3.8 billion over the past month. Pair this with a stagnant spot market volume consistently below $500 million, and we may be in for a mid-summer snooze-fest rather than a spring fling with price spikes. Low volume, low open interest, and a hefty resistance level all indicate that Bitcoin’s momentum could be taking a nap, potentially leading to prolonged low volatility.

Traders Weigh In: A Mixed Bag of Opinions

Around the crypto campfire, pseudonymous trader “The Crypto Monk” suggests that while Bitcoin’s weekly chart shows a neutral trend, getting bearish might not be the best idea just yet. He notes, “BTC closing the week with a ‘neutral’ candle. But still not the best spot to start shorting and becoming a bear. Expecting a retest of $11k.” Meanwhile, derivatives trader Cantering Clark cautions against past mistakes: “Kick yourself if you were selling after a 20% pullback from the highs. Context is everything.”

Looking Ahead: The Fed’s Influence

As we cast our eyes towards the future, the upcoming Federal Reserve meeting is likely to stir the pot. While previous optimistic job reports have sent markets diving, this time, the Fed might continue its laid-back vibe, forgiving potential inflation worries. If the stars align, this could create an atmosphere ripe for both stocks and Bitcoin to flourish. And then there’s PlanB, the mastermind behind the stock-to-flow (S2F) indicator, who believes Bitcoin might just be standing on the edge of a significant rally, assuming history gives it a little nudge.