Major Investment for Carbonplace

In an electrifying announcement made on February 8, Carbonplace, the blockchain-based carbon credit transaction network, has successfully secured a cool $45 million in funding from a consortium of nine heavyweight banks. These banks collectively boast a staggering $9 trillion in assets under management. Among these banking giants are BBVA, BNP Paribas, CIBC, Itaú Unibanco, National Australia Bank, NatWest, Standard Chartered, SMBC, and UBS. Talk about a financial heavyweight championship!

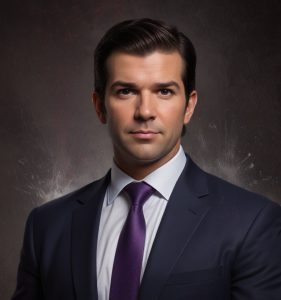

Going Independent with New Leadership

With this fresh influx of cash, Carbonplace is gearing up to transition into an independent entity while embracing a new captain at the helm — Scott Eaton has been appointed as the new CEO. This change could see Carbonplace elevate its game, enabling it to serve a broader client base while fostering innovative partnerships across the carbon marketplace.

The SWIFT of Carbon Markets

So, what’s the game plan for Carbonplace? They aim to establish themselves as the “SWIFT of carbon markets.” This means they’ll provide a robust platform for sharing carbon data in real-time, ensuring that every transaction is secure and traceable. In a world where carbon credits are becoming as trendy as avocado toast, Carbonplace wants to streamline the process.

Meeting Rising Demand

In a commentary on the development, Robert Begbie, CEO of NatWest Markets, quoted some eyebrow-raising statistics from McKinsey, projecting that global demand for voluntary carbon credits could skyrocket by 15 times in the coming years. Talk about a rush! Yet, Carbonplace seems more than ready to ride this wave with scalable technology designed specifically for eco-conscious businesses.

Service Launch and Functionality

While the official service launch is on the horizon for later this year, Carbonplace isn’t sitting around twiddling their thumbs. They’ve already initiated pilot trades with notable companies like Visa and Climate Impact X. By leveraging their own distributed ledger technology, they’re making offset transactions easier than ordering pizza online. Plus, they’re utilizing digital wallets to ensure owners can clearly demonstrate ownership while eliminating double counting—because seriously, nobody wants to pay for the same slice twice!

+ There are no comments

Add yours