Introduction: The Struggle to Retrieve Funds

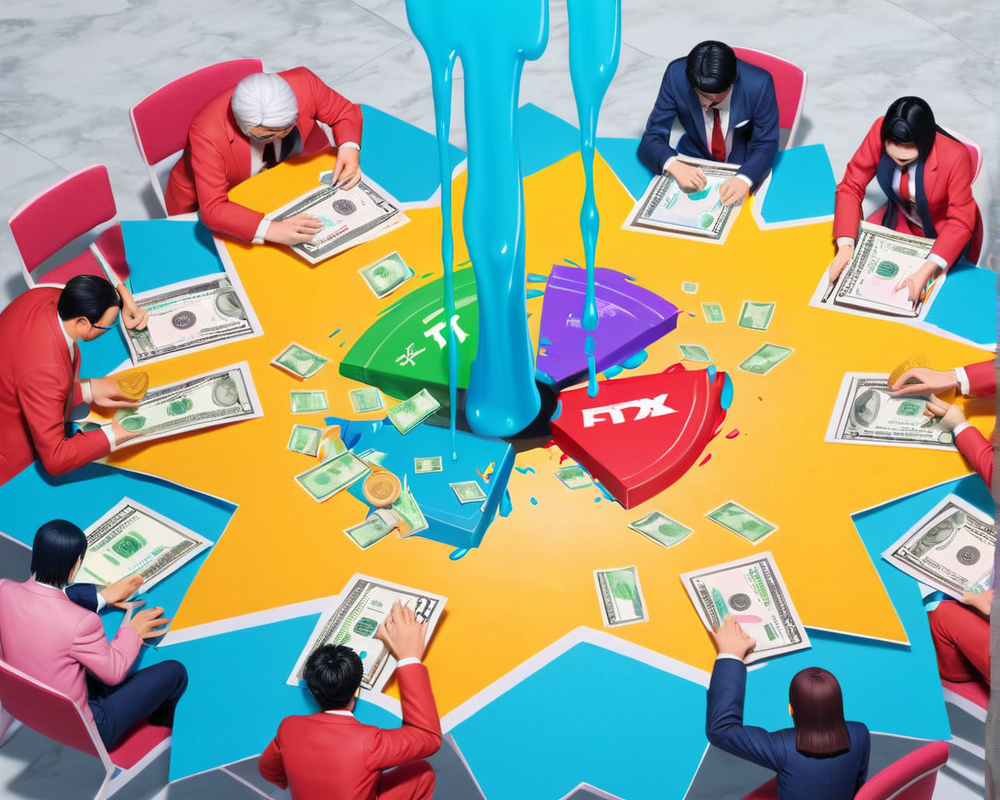

The FTX crisis continues to unfold, affecting countless users of the platform as they seek ways to retrieve their investments from the collapsing exchange. Amidst a backdrop of regulatory compliance and liquidity challenges, FTX announced on November 10 that it would begin facilitating withdrawals for Bahamian funds, igniting a series of creative—yet questionable—strategies among users desperate to access their capital.

Official Withdrawals Resume for Bahamian Users

Initially, FTX communicated that the facilitation of withdrawals would comply with the demands of regulators in the Bahamas. The tweet stated:

“Per our Bahamian HQ’s regulation and regulators, we have begun to facilitate withdrawals of Bahamian funds.”

As news circulated, many users in other regions watched closely, while others took matters into their own hands.

Using NFTs to Circumvent Withdrawals

In an attempt to bypass the collapsing bankruptcy process, some FTX users began buying nonfungible tokens (NFTs) listed on the FTX marketplace for sale by Bahamian-based accounts. This allows users with stuck balances to pay with their assets while enabling Bahamian users to withdraw funds. Podcaster Cobie noted that these transactions are becoming increasingly common as users explore various strategies to access their wealth.

It has been reported that millions in Tether (USDT) have already been withdrawn through such means. In this undercurrent of desperation, community members have started sharing their experiences and results.

Bribing FTX Employees for KYC Processing

In addition to utilizing NFTs, some users have resorted to offering bounties to FTX employees to expedite their Know Your Customer (KYC) applications or adjust their account details to reflect residency in the Bahamas. Reports include offers such as:

“I’ll pay $1 million to have someone change my residency to the Bahamas.”

This tweet was later clarified as a “funny experiment,” although it reflected a genuine sentiment among users looking for tactics to withdraw funds. Another trader, AlgodTrading, publicly offered $100,000 to an FTX employee for assistance with his KYC request, ultimately succeeding in withdrawing his funds.

Ethics and Risks of Bypassing Procedures

While these tactics may appear to provide pathways for some, not everyone sees these maneuvers as wise. Crypto researcher FatMan criticized the approach, cautioning against bribing FTX employees and undermining the credit and bankruptcy processes:

“Bribing an FTX employee and bypassing the credit process for other people’s balances is not the brightest idea.”

Conclusion: Navigating a Complex Landscape

The situation surrounding FTX continues to evolve, presenting unique challenges for users trying to access their funds amid turmoil. As innovative but controversial methods emerge, the need for greater transparency and adherence to proper processes is more critical than ever. The responses from the crypto community highlight the desperation felt by many, but also serve as a reminder of the importance of ethical practices as the industry navigates through its current challenges.