Introduction to the Crypto Crime Landscape

Cybercrime in the cryptocurrency world is evolving as real-life criminals adapt newer technologies to stay a step ahead of law enforcement. A recent report from blockchain analytics firm Elliptic shared some eye-opening research on this phenomenon, illuminating the increasing ease with which illicit funds flow through cross-chain bridges and decentralized exchanges (DEXs).

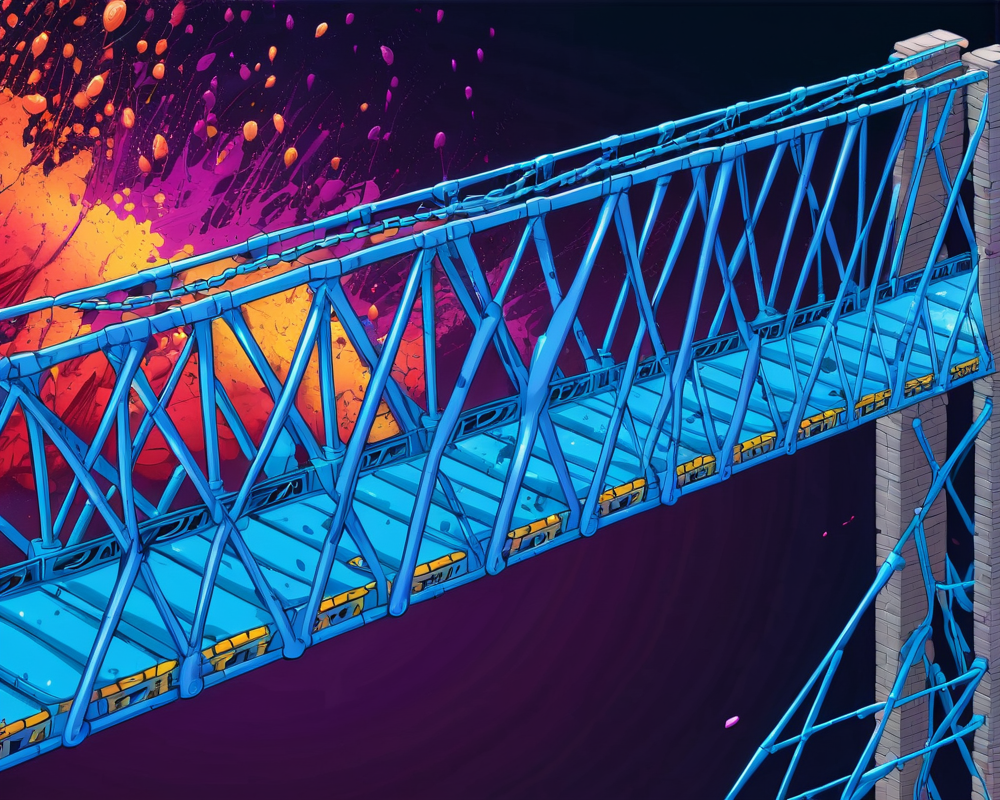

Understanding Cross-Chain Bridges and DEXs

Cross-chain bridges and DEXs are like the superhighways of the crypto world, enabling seamless transactions across different blockchain networks. However, as with any efficient system, these technologies have their dark side.

- Cross-chain Bridges: These act as tunnels between blockchains, facilitating the transfer of assets.

- DEXs: These exchanges allow users to swap cryptocurrencies without relying on an intermediary, making them appealing for those looking to fly under the radar.

The Scale of Illicit Activities

Elliptic’s research revealed some staggering numbers: since 2020, cybercriminals have used these advanced tools to obscure upwards of $4 billion in illegal proceeds. To put it into perspective, around $1.2 billion of this figure came from stolen crypto swapped on DEXs like Curve and Uniswap.

Preferred Platforms for Laundering

When looking at where criminals are pushing their ill-gotten gains, certain platforms come out on top:

- Curve and Uniswap: These two DEXs alone accounted for more than half of the illicit funds swapped.

- 1inch Aggregator: A close third, demonstrating the popularity of these platforms among cybercriminals.

- Coin Swap Services: Also noteworthy, approximately $1.2 billion was laundered using services that facilitate asset swapping across networks without requiring an account.

National Security Concerns

Elliptic calls attention to how wallets linked to sanctioned organizations, notably those connected to North Korea, have laundered over $1.8 billion through these mechanisms. It indicates a growing trend of sanctioned entities exploiting these technologies to carry out cyberattacks.

The Future: Is There a Way Out?

The Stanford research proposes a potential solution with an innovative token standard called ERC-20R. This opt-in feature allows users to reverse transactions within a specific timeframe, providing a fresh means to curb crypto theft. But is it enough?

In the wild west of cryptocurrency, where crime seems to be finding its wings, the journey to secure funds while enhancing the user experience still has a way to go. As they say, “With great technology comes great responsibility—and even greater crime!” Let’s hope we can steer this ship to safer shores!