Bank of Korea’s Forward-Thinking Strategy

The Bank of Korea (BOK) is diving headfirst into the world of digital currencies! In its December briefing on monetary policy for 2020, BOK announced plans for a dedicated task force to explore the intricacies of central bank digital currency (CBDC) research. This could just be the beginning of a digital transformation that has the potential to redefine financial transactions in South Korea.

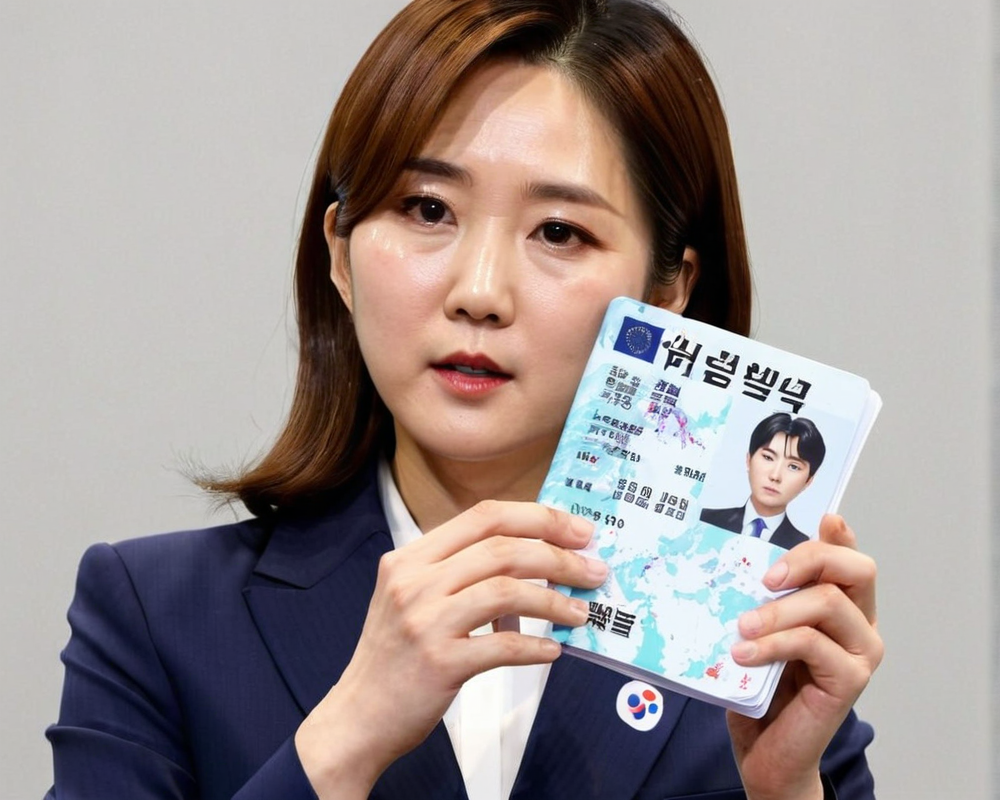

Recruitment Drive for Digital Currency Experts

As part of its ambition, BOK is loking to boost its brainpower by recruiting a team of digital currency experts. A job listing was posted back on December 10, indicating that the bank is ready to assemble a squad of financial wizards to tackle this cutting-edge technology. Getting the right people in the room is crucial — who better to address the challenges posed by digital assets than those who specialize in the field?

Collaborations and Global Perspectives

In addition to forming a task force, BOK plans to have a chit-chat with international partners. Discussions with the Bank of International Settlements (BIS) and other relevant organizations are on the agenda to keep BOK up-to-date on the latest CBDC developments happening around the globe. After all, when it comes to digital money, two (or more) heads are better than one!

Assessing Financial Market Infrastructure

The BOK will also take a leaf out of BIS’s book by implementing the Principles for Financial Market Infrastructures (PFMI). This framework allows the bank to apply assessment standards and enhance oversight of its domestic financial systems. Think of it as a safety net for financial transactions, ensuring that every digital dollar is as secure as its physical counterpart.

What’s the Deal with Retail CBDCs?

Now, let’s talk implications. A CBDC essentially acts as a digital version of cash issued by the central bank, sporting the same legal tender status as traditional money. However, BOK has hesitated on launching a retail CBDC for the public, citing the potential risks. You see, there’s a fine line between innovation and chaos; a retail CBDC could introduce instability in commercial bank deposits and potentially trigger bank runs — you know, the kind of thing that keeps bankers up at night.

Looking Ahead: Global Trends and Local Insights

Other nations are adopting different approaches. For instance, France is prepping to pilot a wholesale CBDC in 2020, a move that has already grabbed headlines. As global interest continues to grow, it’ll be thrilling to see what BOK’s deep dive into CBDCs reveals — just imagine the dollars, now in a digital format!