The Launch of BGBF-I

The BCMG Genesis Bitcoin Fund-I, affectionately shortened to BGBF-I, has thrown its hat into the institutional crypto ring, claiming to be the very first insured cryptocurrency investment option in the lush, vibrant lands of Southeast Asia. With its grand opening, the fund aims to satisfy an ever-growing appetite for institutional-grade crypto products in the region.

What’s Behind the Fund?

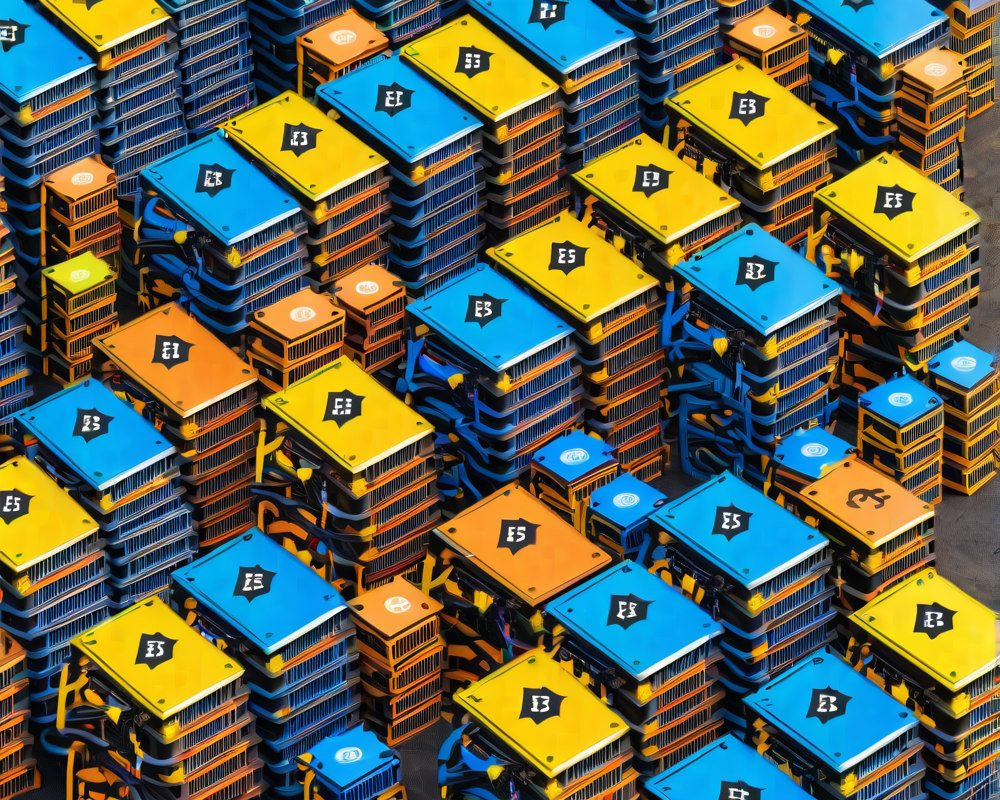

In a world where digital currencies have captured the imagination of investors, BGBF-I stands out like a shiny Bitcoin on a dark day. This fund is powered by an Artificial Intelligence (AI) driven, blockchain-based platform provided by Calfin Global Crypto Exchange. What does this mean for investors? Well, it suggests an interesting cocktail of increased security and innovative technology, but let’s not drink too much of that Kool-Aid just yet!

Regulatory Backbone and Support

BGBF-I operates under the regulatory watch of Labuan, Malaysia, where they’ve got more than just palm trees and beaches going for them. IBH Investment Bank serves as the main advisor, ensuring that everything is above board. Additionally, the Hong Kong-based Alpha Calibration chimes in to provide regulatory compliance, while HLB Hodgson is on hand for auditing duties. When it comes to financial scrutiny, it seems they’ve covered their bases!

Insurance, Security, and Those Sweet Returns

Hold onto your hats, because this is where things get exciting. The fund includes insurance coverage and underwriting for Public Offering Security Insurance. Fund Manager Subbu Vempati confidently states that BGBF-I is a “secure, insured, and regulated platform.” This means investors can dive into the digital asset pool with the peace of mind generally reserved for naps on a Sunday afternoon.

According to the fund’s website, BGBF-I projects a minimum yearly return of 12%. Compared to Bitcoin’s impressive skyrocketing gain of 266.5% over the past year, it’s like watching your dog fetch a stick while high-fiving your neighbor.

Diving Into the Digital Asset Pool

Of course, they’re not just letting anyone wade into these murky waters. All accredited investors will have to go through the rigorous, yet necessary, Anti-Money Laundering (AML) and Know Your Customer (KYC) screenings. So, it looks like you’d better bring your identification card and a good reason for wanting to invest in this fund.

BTC and Other Digital Waves

BGBF-I is not alone on this digital frontier. Recently, the institutional desire for Bitcoin and other digital assets has been undeniable, with the approval of North America’s first physically settled Bitcoin ETF in Canada signaling a growing trend. Meanwhile, Grayscale’s trustworthy Bitcoin Trust keeps pushing the envelope, boasting $39.8 billion in assets under management. So grab your surfboard; the crypto wave is just getting started!