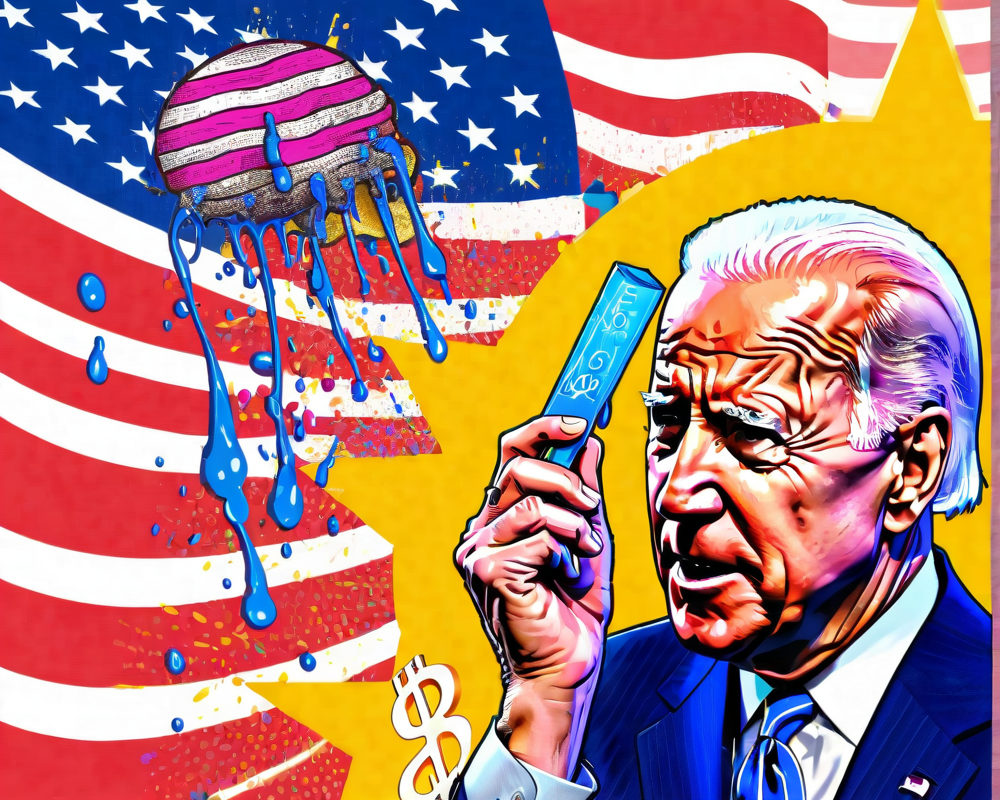

Unpacking the Relief Bill Rejection

President Joe Biden’s thumbs down on a Republican COVID-19 relief proposal has certainly stirred the economic pot. The GOP’s plan offered a meager $618 billion, which Biden, alongside Treasury Secretary Janet Yellen, deemed insufficient to breathe life into the economy still gasping under the pandemic’s weight. This sum, sitting at just a hair under Bitcoin’s market cap, had about as much charm as a flat soda at a party.

The Democrats’ Counterattack

In a classic case of political chess, Democrats rallied and voted largely along party lines to shove their revised relief bill of $1.9 trillion through the Senate. Senate Majority Leader Chuck Schumer didn’t mince words, stating that any attempt at a small package would effectively “mire” the U.S. in a prolonged COVID crisis. One can only imagine the metaphoric eye rolls exchanged in closed doors when discussing the GOP’s proposal.

A Partisan House Vote

On the same day, the House of Representatives displayed their own party loyalty, passing the relief bill with a close vote of 216-210. Spoiler alert: not a single Republican was on board. Talk about a divided house! You could hear the crickets chirping in the GOP corner as they watched the Democrats push forward like an unstoppable train.

Economics 101: The Debt Dilemma

As if the situation weren’t complicated enough, let’s consider the backdrop of America’s ballooning debt, nearing a staggering $28 trillion. That brings the debt-to-GDP ratio above 130%, a record that would impress even the most seasoned financial circus performer. With the Federal Reserve printing more cash in 2020 than in the first 200 years of existence combined, one must wonder if the creaky U.S. financial system is setting itself up for a fall—or a really big party where everyone forgets the hangover.

Bitcoin’s Potential Bullish Future

Now, amid all this economic chaos, how does Bitcoin fit in? Experts believe that the Federal Reserve’s relentless money-printing spree plays right into Bitcoin’s hands, igniting uncertainty around the dollar. Tyler Winklevoss, co-founder of Gemini, suggests that every time the Fed clicks ‘Print’, Bitcoin prepares for another bull run. But don’t pop the confetti just yet; with the sheer volume of dollars introduced, inflation is a sneaky thief robbing Bitcoin of its buying power—so even if the price climbs, it may not mean much if you need to buy groceries.

A Speculative Road Ahead

When Biden’s team trimmed the relief bill from an initial $3 trillion down to $1.9 trillion, the speculation surrounding Bitcoin’s price swirled like a tornado. Yes, Bitcoin has soared over 700% since the pandemic hit, but how much gas is really in the tank for the long haul? The question hangs in the air as we closely watch Washington and Wall Street tango over recovery strategies.