Navigating Regulatory Waters

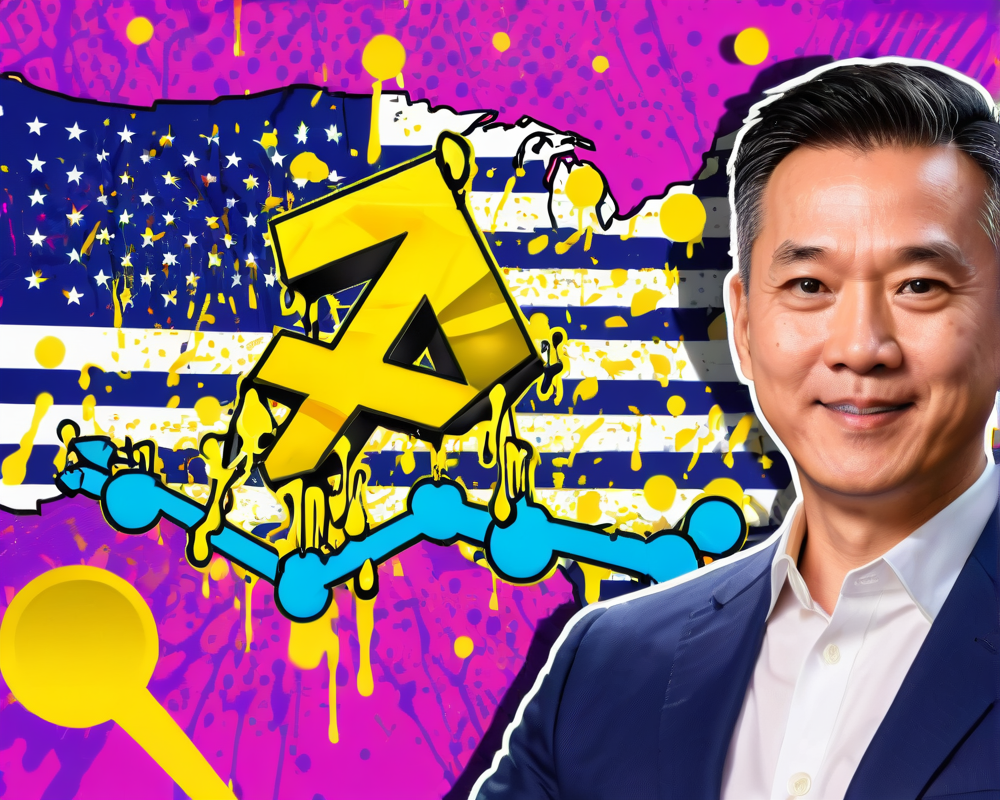

Changpeng Zhao, affectionately known as CZ in the crypto world, recently spilled the beans on Binance’s plans to rekindle its crypto-to-fiat services in the United States. In an interview with Cheddar published on August 15, Zhao hinted at a hopeful timeline, suggesting a mere month or two for resuming operations.

He clarified his statement with an air of caution, stating, “I don’t want to promise any fixed dates, but there’s a lot of work being done…” This comes in light of the firm’s recent announcements where Binance opted to hit the brakes on its U.S. services while securing approval from the Financial Crimes Enforcement Network (FinCEN).

Teaming Up for Compliance

A pivotal player in this regulatory game is Binance’s partnership with BAM Trading Services. Zhao believes this collaboration will pave the way through the often-treacherous regulatory landscape of the U.S. He mentioned, “now we have our partner, we want to take this opportunity and explore the market.” With a friend like BAM, navigating regulations might feel a tad less daunting.

The Market Muddle

Reflecting on the uncertainties stemming from U.S. regulatory measures, Zhao remained optimistic. He remarked, “I think the US is one of the most developed markets… in a large market it is harder to regulate.” It’s like trying to batten down the hatches in a storm; a big ship like the U.S. market is bound to sway a little.

Regulatory Road Ahead

In Zhao’s view, the existing clear framework for traditional financial services might just be the silver lining for the future of crypto regulations. As he summarized, there’s potential for evolution despite today’s chaos.

Binance’s Recent Troubles

But not all news has been rosy for Binance. Just days before Zhao’s interview, the exchange found itself embroiled in a blackmail scandal, facing threats from an alleged hacker demanding a whopping 300 Bitcoins (around $3.5 million). In a real-life drama, this hacker threatened to leak sensitive Know Your Customer (KYC) information if their demands weren’t met.

However, Binance took a firm stand, stating they had no evidence that these KYC images were stolen from their servers. As they clarified, these images date back to February 2018 when a third-party vendor handled KYC verification—a pretty smart way of saying, “Not our circus, not our monkeys!”

Wrapping It Up

In summary, the future seems bright—or at least somewhat hopeful—for Binance’s return to the U.S. market. With careful navigation through the regulatory maze alongside BAM Trading Services, and a dose of optimism from CZ, there just might be a fresh chapter for crypto in America.