The Bitcoin Debate

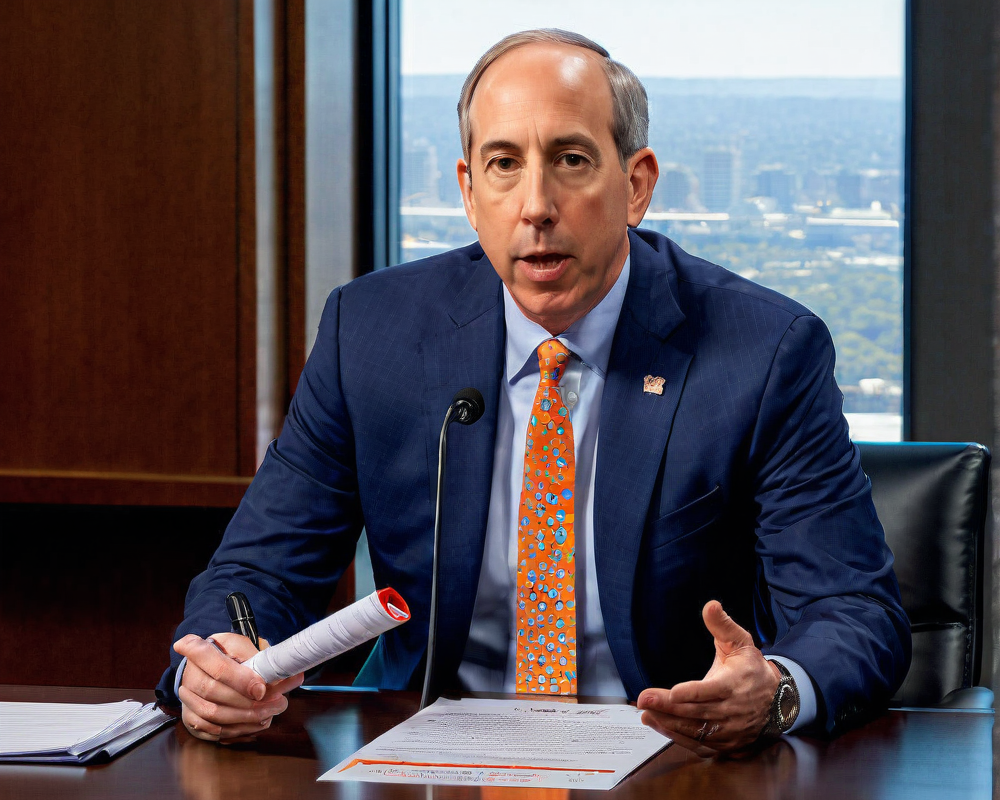

For over a decade, Bitcoin has been the topic of vigorous debates, with many skeptics labeling it a bubble waiting to burst. Enter Michael Wu, CEO of Amber Group, who recently redefined the narrative in a CNBC interview, suggesting it’s time to reconsider these beliefs. As he aptly put it, skepticism is human nature when confronted with paradigm shifts.

Understanding the Skepticism

Wu elaborates on the skepticism surrounding Bitcoin, noting that it’s a common reaction when people face something new. He highlighted that as understanding evolves, so too does acceptance. As newcomers grapple with the uncertain waters of cryptocurrency investment, price volatility has been a hallmark, yet Wu asserts this shouldn’t define Bitcoin’s value in the long run.

The Institutional Shift

One of the turning points in the Bitcoin narrative came with its recent adoption by mainstream institutions. Large players like Microstrategy, MassMutual, and Square have taken the plunge into Bitcoin, with investments that speak volumes about confidence in the cryptocurrency’s potential. Wu pointed out that the interest from billionaires and publicly traded companies indicates a strong demand amidst a finite supply of 21 million Bitcoins, a fact that bolsters its value proposition immensely.

The Case for Long-term Viability

While Wu acknowledges that price swings will continue to be part of Bitcoin’s journey, he argues that the asset has matured beyond the bubble phase. He believes that our understanding and acceptance of Bitcoin as a stable store of value will only deepen as more institutions and individuals invest. His comparison of Bitcoin to gold—“the worst-case scenario for Bitcoin is still a better form of gold”—suggests that Bitcoin might serve as a more resilient asset in turbulent times.

Trading Spaces: The Amber Group’s New Horizons

In a bold move to bolster both institutional and retail engagement, Amber Group recently appointed Annabelle Huang to spearhead their GlobalX Center. This initiative aims to expand the company’s product offerings across key markets, including South Korea, Japan, and North America. The team’s focus on growing this global footprint signals an exciting period for cryptocurrency investment and innovation.

Conclusion: Moving Forward with Bitcoin

As we continue navigating the evolving landscape of cryptocurrency, it’s crucial to parse through the skepticism. Bitcoin’s journey, fueled by increasing institutional backing and a finite supply, suggests that while volatility is here to stay, the case for its long-term stability is stronger than ever. Wu’s insights challenge us to rethink the narrative surrounding Bitcoin—not merely as a speculative bubble but as a permanent fixture in the financial ecosystem.