Miners in a Cost-Cutting Mood

As we step into 2023, Bitcoin miners are trading in their party hats for some financial discipline. After a tumultuous 2022, where many saw their stocks sink like a lead balloon, the clear message from analysts is: watch those balance sheets! Public miners, largely burdened by the high costs of reporting, are seriously considering going private or merging to cut down on admin expenses. One can only imagine the boardroom discussions—”Hey, let’s be a little less public about our private struggles!”

Debt Restructuring: The New Buzzword

A major focus for miners this year will be restructuring their soaring debt levels. It’s like a financial diet, but instead of cutting calories, they’ll be negotiating lower interest rates or extending payment deadlines. As Hash Rate Index analysts Jaran Mellerud and Colin Harper note, this is not just a trend; it’s becoming a lifeline. Miners cannot afford to be the ones left behind as they seek ways to stay afloat in a bear market.

The Great Hedge: Protecting Against the Unknown

In 2023, Bitcoin miners are expected to embrace risk management strategies, including the use of Bitcoin mining derivatives. These commodities allow miners to sell their future hash rate at predetermined prices, which could cushion the fluctuations that come with Bitcoin’s unpredictable nature. Picture it as hedging your bets—except instead of at a racetrack, it’s about maintaining your mining operation’s economic viability.

Mergers: Marrying for Money

This year may be the year of strange bedfellows as public mining companies consider merging. The idea is that by joining forces, they can pool resources and cut costs. You could call it a financial shotgun wedding, but instead of “Love is in the air,” it’s more like “desperation is in the air.” Analysts suggest that the merging of companies will become the norm, leading to bigger entities that can better withstand market turbulence.

A Hopeful Outlook? Maybe Not Just Yet

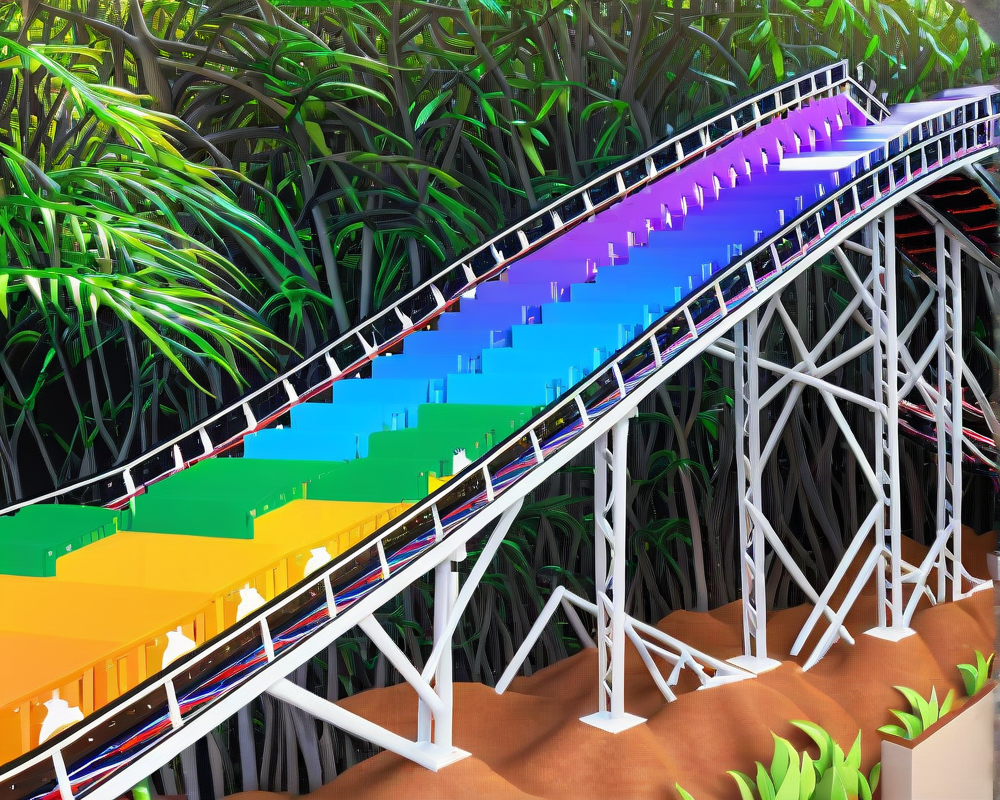

Despite the doom and gloom, there’s a glimmer of hope. The analysts hint at the possibility of the Bitcoin bear market seeing some closure this year—though refueling into a full-blown bull market might take a couple more years. So, while miners rush to save their businesses, the Bitcoin community braces itself for yet another wild ride on the price rollercoaster.