Bitcoin Bounces Back Amid Economic Optimism

On August 26, Bitcoin (BTC) experienced an unexpected surge, climbing 3.55% to reach levels it had hit earlier in the week. This bounce came shortly after disappointing investor prognostications were replaced by a hopeful economic report from the United States. The Personal Consumption Expenditures Price Index (PCE) data came in lower than forecasted, fanning the flames of optimism among traders and investors alike.

The Market’s Reaction: Riding the Bull

Just a few hours before Bitcoin’s upswing, markets were gripped by anxiety ahead of Fed Chair Jerome Powell’s speech in Jackson Hole. But with the new PCE data, traders breathed a collective sigh of relief, sending Bitcoin on a bullish rampage. Social media was alive with the excitement, depicting an optimistic sentiment, though analysts cautioned against overexuberance.

Analysts Weigh In: Caution in the Midst of Optimism

Despite the encouraging news, analysts like Caleb Franzen and Kevin Svenson continued to urge caution. Franzen noted that while BTC/USD had rebounded, resistance levels loomed large, keeping traders on their toes. Svenson echoed similar sentiments, suggesting that while the market might react positively to the PCE data, Powell’s upcoming speech could lead to a market reversal. “It’s kind of a coin flip right now,” he stated.

Long-Term Trends: The Mighty Bear Lurking

As the excitement of the day settled, the reality of Bitcoin’s long-term trends came to light. Analyst Caue Oliveira pointed out a continuing downward trend in network usage, suggesting that any bullish momentum could be fleeting. Stats showed that Bitcoin’s median transaction volume was close to two-year lows, painting a picture of low trading appetite. The bearish sentiment reflected on exchanges’ BTC reserves sinking to four-year lows. “Good time for long-term accumulators, but for short-term traders, caution is needed,” Oliveira concluded.

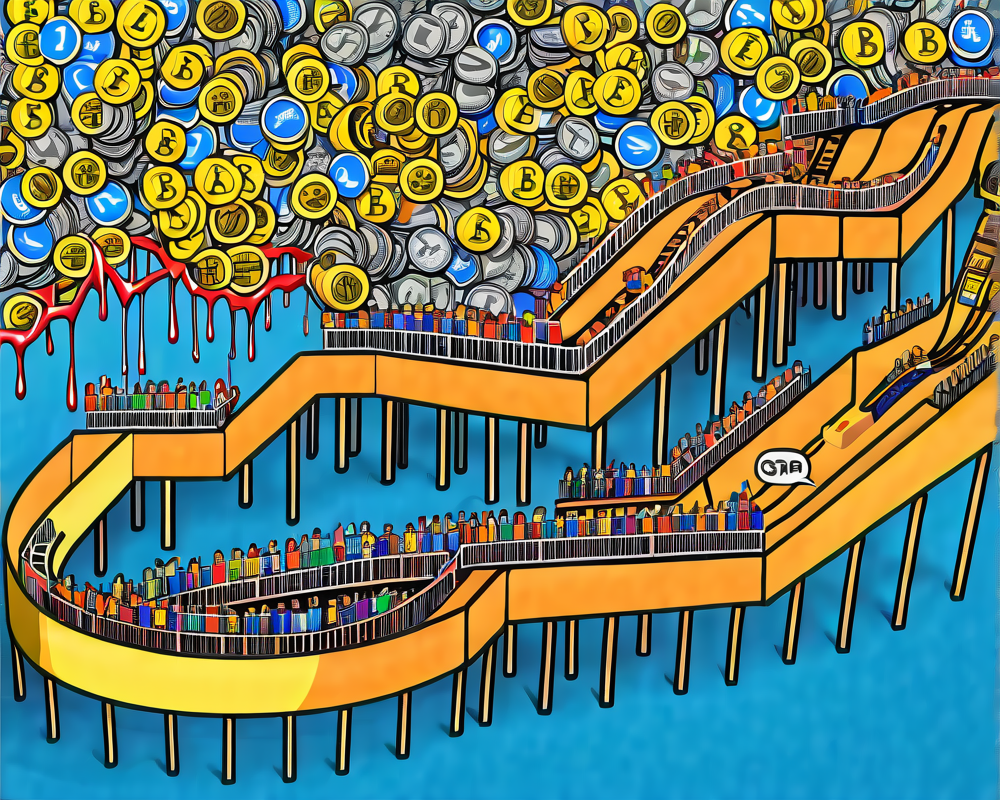

Conclusion: The Crypto Rollercoaster Continues

As the crypto community navigates the ups and downs precipitated by economic indicators, one thing is clear: Bitcoin’s journey is far from over. With external factors like inflation data and Federal Reserve policies influencing market movements, investors must remain astute and responsive. Buckle up, because it looks like the Bitcoin rollercoaster is going to keep chugging along!