Bitcoin’s Surge Amidst Bank Drama

Between March 12 and 13, Bitcoin shrugged off its gloomy demeanor and shot up by a whopping 14.4%. Thanks to a little thing called a financial rescue plan for depositors at the soon-to-be extinct Silicon Valley Bank (SVB), BTC found itself frolicking around an intraday high of $24,610 before settling down to a cozy $24,000. This figure is no small change, marking a solid 45% increase year-to-date. So, siked up yet or are you still clenching your investment pearls?

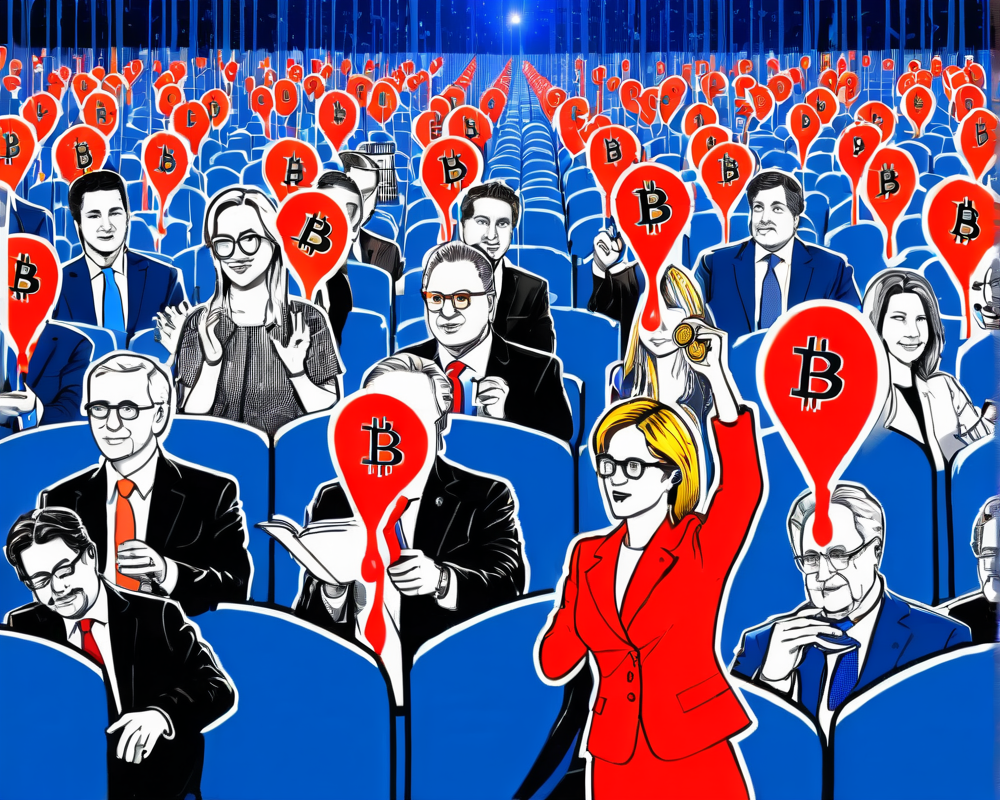

Regulators to the Rescue

In a classic case of ‘don’t panic, we got this’, U.S. Treasury Secretary Janet Yellen, Federal Reserve Chairman Jerome Powell, and FDIC Chair Martin Gruenberg put out a joint statement like a superhero trio, ensuring terrified depositors there would be no losses on the books. With the announcement of a systemic risk exception for Signature Bank, they threw a lifeline to depositors downstream of the mess created by previous management. Signature Bank, a big shot in the crypto world (think popular kid in school), found itself on the rescue list, while Silvergate Bank recently decided it was time to voluntarily hang up its boots.

The Stablecoin Saga

The narrative wasn’t all sunshine and rainbows, though. The stablecoin USD Coin (USDC) threw everyone for a loop when it dropped its trusty 1:1 peg with the dollar. On March 10, it bottomed out near $0.87, and let’s just say crypto enthusiasts had their heartbeats racing. The panic escalated when Circle, the company behind USDC, admitted that around $3.3 billion of its reserves were chilling at Silicon Valley Bank. Exchanges like Binance and Coinbase were practically swatting flies as they scrambled to disable automatic USDC conversions, fearing more de-pegging disasters.

Derivatives Metrics: The Market’s Crystal Ball

Now, while Bitcoin’s price swings were dramatic, the Bitcoin futures market felt the tremors too. Quarterly futures, favored by big players (enter: the whales), typically showcase a slight premium to the spot market when times are good – a condition known as contango. However, post-USDC chaos, traders freaked out and the Bitcoin three-month futures premium flipped to backwardation, indicative of a major trust issue in the cryptocurrency realm.

Future of Crypto Banking

Gaining the $24,000 support was like a breath of fresh air for Bitcoin, as it signaled a recovery not observed since Silvergate Bank’s inevitable demise. But the landscape of crypto banking remains precarious. Analysts forecast that as regulators merit a wary eye toward cryptocurrencies, major financial institutions might not be shaking hands with crypto exchanges anytime soon. This results in snowballing concerns for stablecoins, as limited fiat gateways could choke liquidity, making it harder for exchanges to conduct business smoothly.

Conclusion: Confidence and Caution

Even though Bitcoin managed to regain some of its lost glory, the lingering lack of confidence among market players about the long-term recovery still looms over the investing landscape. With regulators playing both security and villain, traders have a recipe for caution mixed with fleeting optimism. Time will tell where this ride leads us next.