Thrilling Times in the Bitcoin Arena

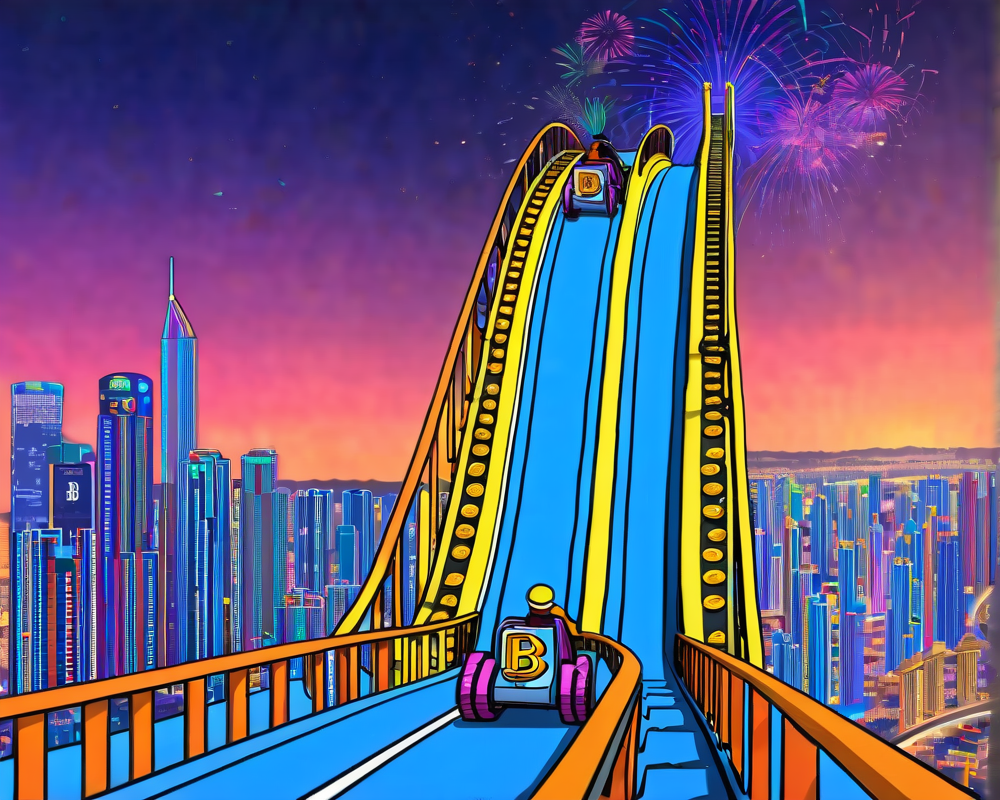

Bitcoin’s price action is resembling a scene from an action movie, complete with cliffhangers and unexpected twists. With the impending $900 million Bitcoin options expiry on May 12, many are clutching their mugs of coffee, expecting sparks to fly in the crypto marketplace. Can Bitcoin dodge diving below the $27,000 mark? Let’s explore.

Back to the Future or Just Another Downturn?

Only days ago, Bitcoin had its eyes set on the magical $30,000 threshold. The BTC/USD pair seemed to be breaking free like a teenager who just earned their driver’s license, only to come screeching back down after hitting the rough patch of resistance around $30,000. This latest bout of indecision left traders feeling like coiled springs, primed for the next movement.

Analyzing the Current Landscape

Bitcoin trudged through a tumultuous correction, dipping 8.2% to test the $27,400 support level. Major players like Warren Buffett, the oracle of Omaha himself, are less than jazzed about U.S. economic growth, contributing to a climate of uncertainty that might just scare off potential crypto investors like a bad horror movie.

Bear vs. Bull: The Optimism Showdown

Let’s talk options: The upcoming May 12 expiration is mixed with optimistic and pessimistic sentiments. The open interest may stand at a staggering $900 million, but speculation suggests some bears are preparing their own version of a Grinch-like heist below the $28,000 range.

Hope vs. Reality

With a 1.65 call-to-put ratio, there’s a battle brewing between bullish and bearish sentiments. The call options (buying bets) sit at $560 million while the put options (selling bets) are resting at $340 million. However, if the price stays around $27,500, the bulls might have a rude awakening come expiry—their call options could be worth a mere $11 million!

Possible Scenarios for May 12

Based on current market action, fasten your seatbelts, here are the potential scenarios:

- Between $25,000 and $27,000: 100 calls vs. 9,900 puts. The bears could be sitting pretty, with profits rolling in at $230 million.

- Between $27,000 and $28,000: 400 calls vs. 5,000 puts. The bears stay in the driver’s seat, profiting by $120 million.

- Between $28,000 and $29,000: 1,500 calls vs. 2,100 puts. We have ourselves a standoff!

- Between $29,000 and $30,000: 3,300 calls vs. 800 puts. The bulls just might have a fighting chance, tipping the scales in their favor by $70 million.

Strategically speaking, a trader could be dancing the options tango—selling puts for a chance to gain positive exposure. But the intricacies involved with options trading make predicting outcomes more complex than untangling your headphones after your gym bag has exploded.

The Closing Act: Bearish Overtones

As the dust settles, Bitcoin seems to stabilize around the $27,500 range. Yet traders remain on alert, as the bearish crowd appears to be better positioned ahead of the weekly options expiry. Will this be a plunge below $27,000, or can the bulls muster the strength for a comeback? Only time and the crypto Gods will tell!