Justice Served: A 42-Month Sentence

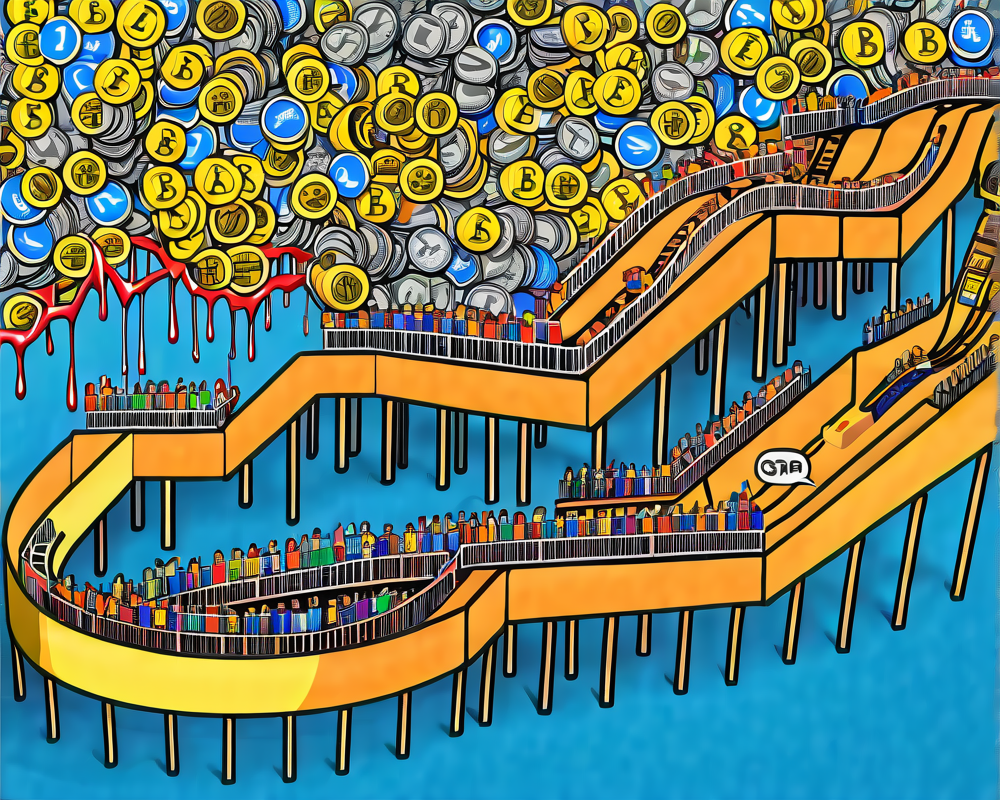

In a striking case of crypto deception, Jeremy Spence, a mere 25 years old, was sentenced to a considerable 42 months behind bars. This verdict comes as a result of his elaborate Ponzi scheme that misled over 170 unsuspecting investors. The social media chatter surrounding his fraudulent operations under the name Coin Signals was far from the financial reality he created. Instead of profits, Spence was showcasing impressive losses while pocketing millions from naive crypto enthusiasts.

The Spell of False Promises

Spence skillfully manipulated his investors by promising cream-of-the-crop returns that never existed. The Department of Justice revealed that he solicited millions under false pretenses, claiming his trading success was monumental. Spoiler alert: It was not. Imagine investing in a fund with the belief it achieved a 148% return. Surprise — it was one giant mirage!

The Financial Black Hole

Between November 2017 and April 2019, Spence ran several cryptocurrency funds while knowing they were losing cash quicker than a kid can lose interest in broccoli. The reality? A staggering over $5 million vanished into his pockets, and the only returns his investors saw were empty promises. His illusion was upheld by creating phantom account balances to obscure the loss — a magician’s trick gone horribly wrong.

The Courtroom Drama

During the sentencing, U.S. District Judge Lewis Kaplan was blunt, stating that the gullibility displayed by investors had real-life consequences and serious implications. Let’s just say, he didn’t sugarcoat it. Meanwhile, Spence offered a hollow apology, expressing feelings of “mortification” and claiming that he’d entered an arena he was woefully unprepared for, as if there is any preparation for duping your fellow humans — I mean, really.

Restitution and Reflection

In addition to prison time, Spence was hit with a hefty bill — ordered to repay over $2.8 million to his victims. Fortunately, his supervised release will allow him to ponder his mistakes outside prison walls, presumably while working at a minimum wage job. Being schooled in the serious repercussions of a life of crime is one thing; learning about the intricacies of crypto trading should probably come with a cautionary tale attached.