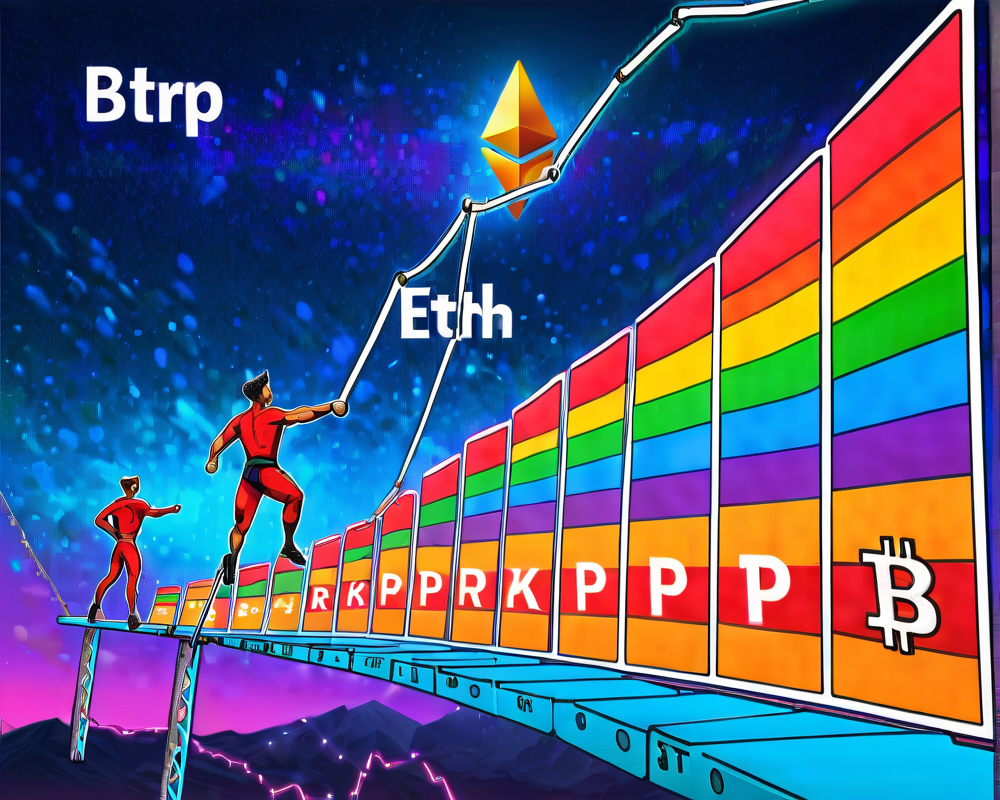

The Ether Rollercoaster: A Wild Ride Below $2,000

After failing to breach the prestigious $2,000 mark, Ether (ETH) has been taking some serious tumbles lately, clocking in a 16.8% correction. Talk about a dramatic plot twist! But hold on; it gets messier. Bears are snoozing on a $1.27 billion options expiry due in August. Will they wake up just in time for the big showdown?

Are We There Yet? The PoS Debate Rages On

There’s a buzz floating around about Ethereum’s shift to a proof-of-stake (PoS) consensus. Some analysts are all in, while others like @DWhitmanBTC are scratching their heads. The crux of the matter?

“If #Ethereum is even money, what’s its supply limit? Can anyone trust it won’t change?”

Without a cap and with monetary policies that seem about as stable as a house of cards, it’s no wonder skepticism hangs in the air.

What’s Cooking with the Merge?

Big news stirred the pot after a developers’ meeting on July 14, hinting at a Merge migration date. Influencer and technical analyst Crypto Rover isn’t exactly optimistic. In his words,

“I think #Ethereum will drop so hard on the Merge day. The anticipation is getting not bought up on the spot market but on the futures market.”

Proceed with caution, folks!

Liquidations Galore: The Price of Leverage

You’d think Ether holders would have seen the steep correction coming on August 18. No such luck—the wreckage resulted in a staggering $208 million liquidated at derivatives exchanges! Talk about a wake-up call. What were these leveraged buyers thinking, swimming in the deep end?

Will the Bears Roar or Just Whimper?

The latest open interest for Ether’s July options expiry stands at a hefty $1.27 billion. However, the bears might end up feeling a bit like sad puppies since ETH dipped below $1,600 in a pre-expiry sneak peek. If prices remain above $1,600, only $95 million in put options will find any ground. Here’s the breakdown:

- Between $1,500 and $1,600: 108,200 calls vs. 103,900 puts. Equal-ish.

- Between $1,600 and $1,700: 45,900 calls vs. 90,000 puts. Bulls lead by $150 million.

- Between $1,700 and $1,800: 192,700 calls vs. 26,000 puts. Bulls flexing with a $290 million lead!

So, the question remains: Do the bulls have what it takes to hold the line?