Price Movements and Market Indicators

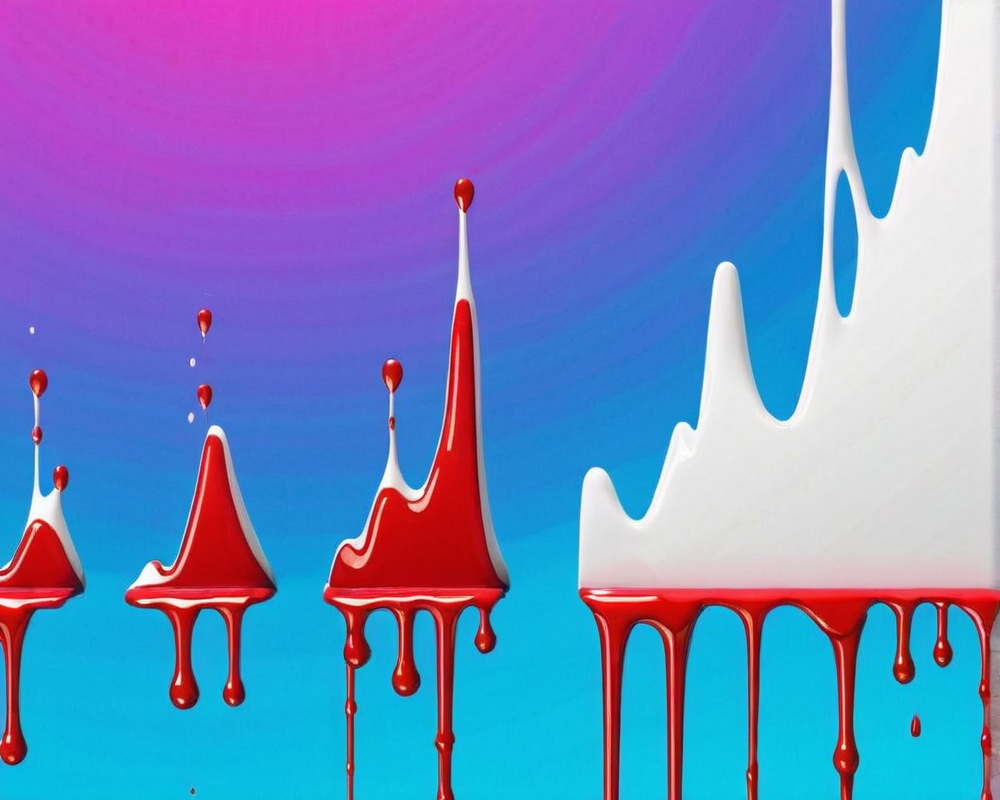

Between January 4 and January 10, Ethereum’s Ether (ETH) made headlines by rising 10.2% and effortlessly crossing the $1,300 mark, which has become a hot topic among traders. Could this be the beginning of an impressive uptrend, or are we merely witnessing a temporary spike? The market seems to be asking whether Ether’s newfound power can lead it into a bullish phase.

Resistance Versus Support: The Ongoing Tug of War

Investors are on edge, pondering whether the formerly hostile $1,300 resistance will transform into a reliable support level for Ether. After a recent test of the $1,200 support on January 1, traders are cautiously observing the eight-week ascending channel’s stability. However, looming negative news may threaten this harmony, pushing Ether bulls to stay vigilant.

Sentiment in the Crypto Sphere: Grim News and Layoffs

Unfortunately, the increasing price of ETH hasn’t significantly brightened the overall sentiment around cryptocurrencies. A string of misfortunes continues, including the confessing of Xiao Yi, a former Communist Party secretary, who admitted to recklessly endorsing crypto mining while apparently behind bars. Meanwhile, Korean tax agents probed into the Bithumb exchange over potential tax evasion following a series of unfortunate events.

The heavyweights of the crypto world haven’t been untouched either. On January 10, Coinbase announced a second wave of layoffs affecting a whopping 20% of its workforce. CEO Brian Armstrong tried to soothe frayed nerves, stating that the company was still “well capitalized” and ready to brave the storm.

Market Reactions: Are Leverage Buyers Retreating?

As uncertainty looms, Ether’s derivatives market indicates that many traders are withdrawing from leveraged long positions, preferring to avoid volatility. Retail traders are typically wary of quarterly futures due to pricing discrepancies with spot markets, while pros tend to favor these tools for their stability.

The futures annualized premium dipped too, revealing traders’ waning confidence despite the previously sky-high fears lacking in today’s market. Remember a healthy market usually showcases futures trading between +4% and +8%. With current values substantially lower, what can we expect?

Understanding the Options Market: Skewing Perceptions

We must delve into Ether’s options market to gauge the likelihood of a market downturn. Typically, the 25% delta skew offers insight about how overly cautious the market is feeling. The current level, sitting at 11%, indicates traders have become more reasonable with put option premiums – a sharp decline from the 19% highs seen at the year’s end.

This data suggests that while confidence is gradually returning among pro traders, they’re still keeping a wary eye on the price trajectory and the possibility of a $600 retest. After all, being bullish doesn’t mean ignoring the risks!

Looking Ahead: What’s Next for Ether?

Even though the news may seem gloomy, the trends within the options and futures markets hint that traders hold on to the hope Ether’s price will hold steady above that $1,300 mark. The resilience displayed by traders may boost Ether’s morale and transform past resistance into steadfast support. But watch out—there’s always a plot twist lurking just around the corner!