The Great Bitcoin Exodus: What’s Happening?

The recent data from Glassnode uncovers a serious trend in the world of cryptocurrency: Bitcoin exchange reserves on Coinbase have diminished by a staggering $8 billion. What does this mean? Well, it seems institutional investors are playing a long game, opting to store their Bitcoin safely away in cold wallets instead of cashing in. Talk about commitment!

HODLing: The Institutional Way

When institutions decide to HODL, it’s not just a meme; it’s a market signal. This strategic hoarding reduces the circulating supply of Bitcoin, hinting at future price increases even when the demand might waver. In other words, less Bitcoin up for grabs could mean more value retention—HODLers rejoice!

Institutional Adoption Is Here to Stay

Institutional adoption of Bitcoin isn’t just a flash in the pan; it’s increasingly looking like the norm. For instance, New Zealand Wealth Funds Management is in on the action, with their KiwiSaver Growth Strategy allocating 5% of assets to Bitcoin since October 2020. They entered the game when Bitcoin was valued at a cool $10,000. Fast forward to now, the firm is sitting pretty on a 518% profit as Bitcoin soared to an all-time high of $61,825.44. If that’s not some sweet financial wizardry, I don’t know what is!

Starry Eyes and Sovereign Funds

In a recent podcast, Robert Gutmann, CEO of New York Digital Investment Group, shared some thrilling tidbits. His firm is inundated with inquiries from sovereign wealth funds eyeing Bitcoin investments. Word on the grapevine is that Temasek, Singapore’s sovereign wealth fund, has been actively purchasing virgin Bitcoin straight from miners. Sounds like a hot new trend in institutional investments!

The ETF Buzz and Its Implications

If the U.S. Securities and Exchange Commission decides to bless us with a Bitcoin exchange-traded fund, hold onto your hats! Fidelity Investments is the latest contender to throw its hat into the ring for a Bitcoin ETF. The implication here is massive—legacy financial firms are not just tiptoeing around Bitcoin; they’re diving in headfirst.

A Positive Overview

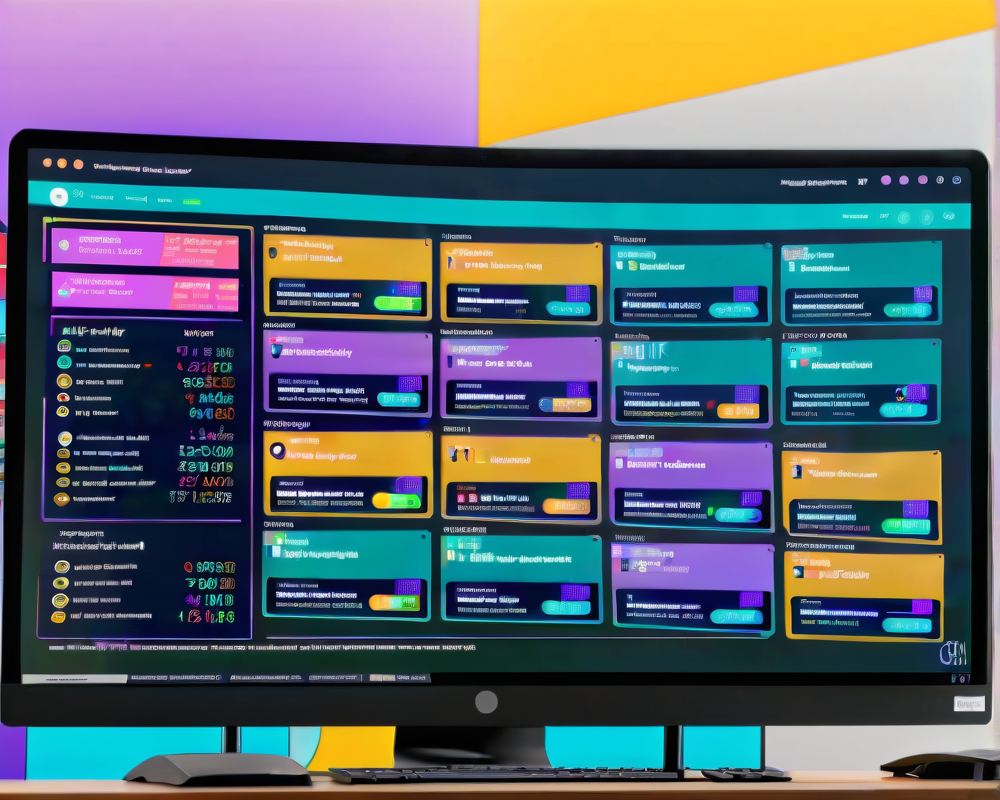

The influx of diverse investors into the crypto realm signals something promising. While we can be optimistic about the long haul, let’s stay grounded and examine the charts of the top ten cryptocurrencies to assess any short-term trends.