The Whoops of FTX

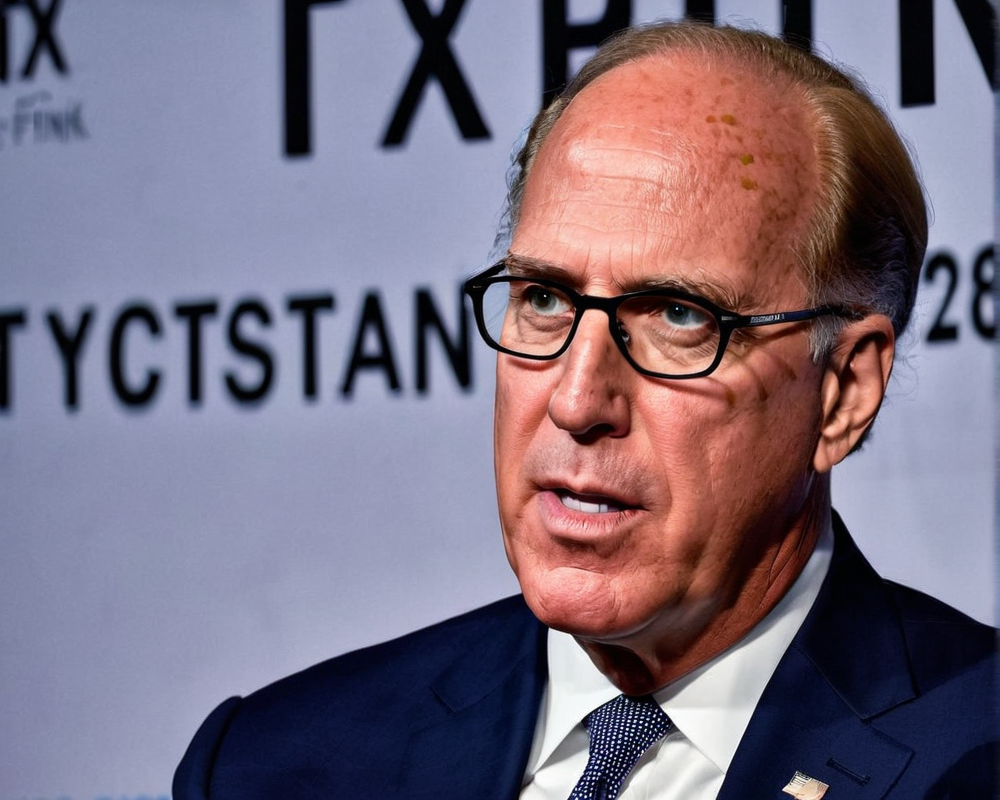

Larry Fink, the head honcho of BlackRock—yes, the giant $8 trillion asset management firm—has some strong thoughts on what went south with the now-infamous FTX. During the 2022 DealBook Summit, he attributed FTX’s spectacular collapse in part to its own FTX Token (FTT), claiming it undermined the very essence of what cryptocurrency stands for: decentralization.

Famous Last Words: Centralization

Fink’s skepticism shines like a spotlight on centralized exchange tokens. True to form, he tossed in a penny for his thoughts on other players like BNB and Crypto.com’s Cronos, saying they amount to over $57 billion in the total crypto market cap of $862 billion. Spoiler alert: he doesn’t think too many of these companies will be around in the future.

The Skeptical Investment

The entrepreneur’s tune turned introspective when he acknowledged that BlackRock had a $24 million stake in FTX. When prompted about whether due diligence had flown out the window for major investors like Sequoia Capital and BlackRock, he played the diplomatic card. He noted that while “judgment calls” could be made post-factum, firms like Sequoia had a long history of stellar returns, implying faith in their research processes.

Tokenization: The Future, According to Fink

Amidst all the doom and gloom, Fink did offer a glimmer of hope for the crypto and blockchain world. He confidently stated that tokenization would define the next era of markets and securities. Forget banks and middlemen: instantaneous settlement would be the name of the game. Picture paying for bonds and stocks without that torturous waiting period; sounds dreamy, doesn’t it?

How It Works

If we dive into Fink’s vision for tokenization, it opens up a world where distributed ledgers track every transaction, making market behavior transparent and immediate:

- Immediate show of ownership.

- No more reliance on slow banks.

- Lower fees—cha-ching!

BlackRock’s Crypto Journey

Despite its recent hiccups, BlackRock has been dipping its toes in crypto waters since 2020. Just recently, they announced a partnership with Circle to manage its USD Coin reserves, and they rolled out an ETF designed to provide access to 35 blockchain-related companies. Yes, they’re still in the game! Fink believes the revolution is still brewing, even if one of its players fell flat.