The Urgent Call for Crypto Registration

In a bold statement that could rattle the digital asset world, Gary Gensler, the head honcho at the SEC, is once again knocking on the doors of crypto projects. His message is clear: if your project involves securities, it’s time to come to the regulatory table. After all, investors deserve a protective bubble around their crypto investments, and the SEC aims to be that bubble maker.

Collaboration for Safety

Gensler isn’t working in a vacuum; he’s collaborating with the Commodities Futures Trading Commission (CFTC) to strengthen investor safeguards. As he preps for his testimony at the Senate Committee on Banking, Housing, and Urban Affairs on September 14, the SEC is gearing up to unveil a comprehensive policy framework alongside the Federal Reserve, Treasury Department, and even President Biden’s financial task force. It’s almost like forming a superhero alliance—but for finance.

Tokens and Securities: A Matching Game

“Platform operators, we know you have a treasure chest of tokens, but let’s get real,” Gensler stated with tongue-in-cheek exasperation. Of the many tokens on the market—be it a mere 50 or an overwhelming 1,000—it’s highly unlikely that a given platform possesses zero that fall under the category of securities. Even a few nuggets can turn a platform into a treasure trove of regulatory headaches!

Innovation Meets Regulation

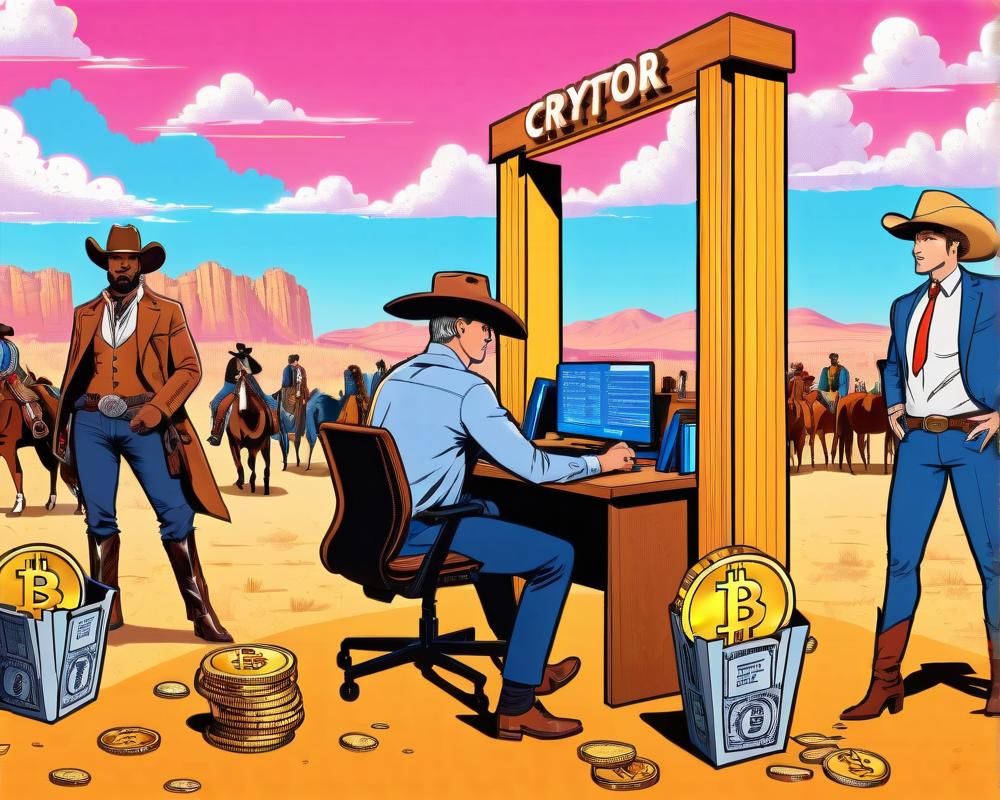

While Gensler acknowledges the potential for crypto to stir up transformative change in finance, he insists this can only happen if such innovation operates within a structured legal framework. Without proper guidelines, the realm of digital currencies feels more like a chaotic Wild West than a well-organized marketplace. The SEC chair believes that many firms are using regulatory ambiguity as a shield—claiming they can’t comply because no clear rules exist.

Time to Face the Music

“You have to register with the Commission unless you qualify for an exemption,” Gensler emphasized. With plans to tighten the policy reins around token offerings, decentralized finance (DeFi), stablecoins, and more, the SEC is on the cusp of potentially rewriting the rulebook for how these projects operate. Many in the crypto space might groan at the thought, but Gensler argues that without adequate protections, investors are like sheep roaming in a field full of wolves—ripe for exploitation and scams.

Upcoming Showdown

Mark your calendars—on September 14 at 10:00 AM EST, Gensler will showcase his arguments during a full hearing on SEC oversight. Will it usher in new regulatory changes, or will it be just another day in the tumultuous world of crypto? Only time will tell, but one thing is for certain: investors and crypto projects alike should keep their eyes peeled.