Clashing Views on Cryptocurrency and Sanctions

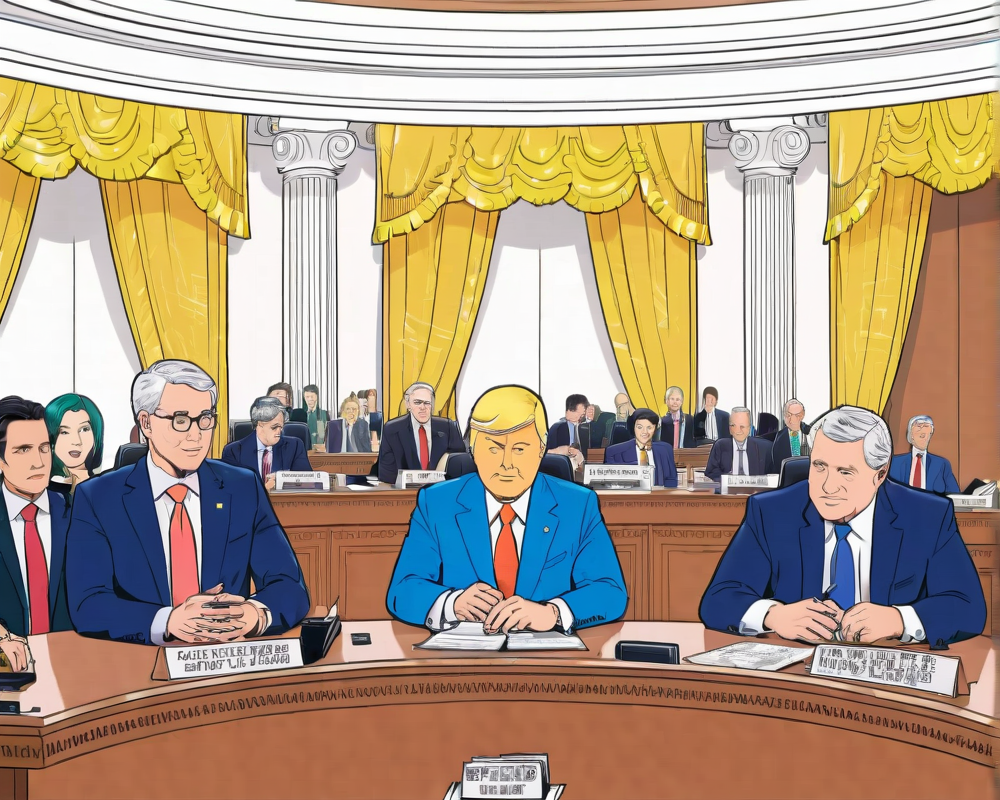

During a recent Senate hearing, industry experts and lawmakers found themselves on opposing sides when discussing how to tackle the use of digital assets for illicit activities. The hearing, aptly titled “Understanding the Role of Digital Assets in Illicit Finance,” revealed significant divides in opinion.

Michael Chobanian Takes Aim at Binance

Taking a strong stance, Michael Chobanian, founder of Kuna crypto exchange, pointed fingers at Binance. He accused the exchange of still engaging in operations with the Russian ruble, raising concerns about adherence to sanctions against Russia. Chobanian noted that Kuna ceased all support for the ruble to boost Ukraine’s economy amidst ongoing aggression from its neighbor.

Chobanian’s Plea for Solidarity

Chobanian urged global crypto exchanges, including Binance, to prevent any transactions involving sanctioned individuals until a democratic resolution is achieved in Russia. His plea echoing a mix of urgency and frustration highlighted the ongoing humanitarian crisis.

Senators Weigh In: Crypto as a Sanction Bypass?

Some lawmakers expressed skepticism about the notion that cryptocurrencies could aid wealthy Russians or Putin in evading sanctions. Senator Pat Toomey claimed, “There’s no evidence of cryptocurrencies being used by Russia to evade sanctions in any significant way.” His argument underscored the inherent traceability of digital assets, making them a risky avenue for nefarious activities.

Balancing Good and Evil

The discussion showcased the duality of cryptocurrencies: while they might provide a way for rogue nations to undermine economic penalties, they also allow for swift aid. Chobanian contrasted the ten-minute setup for crypto donations to Ukraine with the lengthy ten-day process undertaken by the National Bank of Ukraine for traditional fiat transfers.

The Ransomware Debate

The conversation inevitably turned to ransomware attacks, notorious for demanding cryptocurrency payouts. However, Jonathan Levin from Chainalysis noted that only a minuscule percentage (0.15%) of digital asset transactions in 2021 were tied to illicit activities. This statistic paints a picture of a system laden with potential yet mischaracterized by sensational headlines.

Critical Reflections on Cybercrime Attribution

Michael Mosier, former acting director of the Financial Crimes Enforcement Network, cautioned against overemphasizing the relationship between cybercrime and cryptocurrency. He argued for the exploration of fundamental causes behind these crimes instead of merely blaming the medium of exchange.

Calls for Regulatory Clarity

A continued theme throughout the hearing was the lack of clear regulations in the crypto space. Senator Cynthia Lummis expressed an intention to introduce comprehensive legislation to clarify regulatory frameworks for cryptocurrencies. Meanwhile, Senator Elizabeth Warren unveiled her initiative aimed at mitigating crypto’s potential for facilitating economic crimes.

The Need for Collaboration

Ultimately, experts emphasized the necessity for clarity and cooperation in crypto regulations. Mosier concluded that clear guidelines would help firms ensure compliance and nurture a responsible crypto ecosystem.