Compliance Over Creativity: The Dilemma for Swan Bitcoin

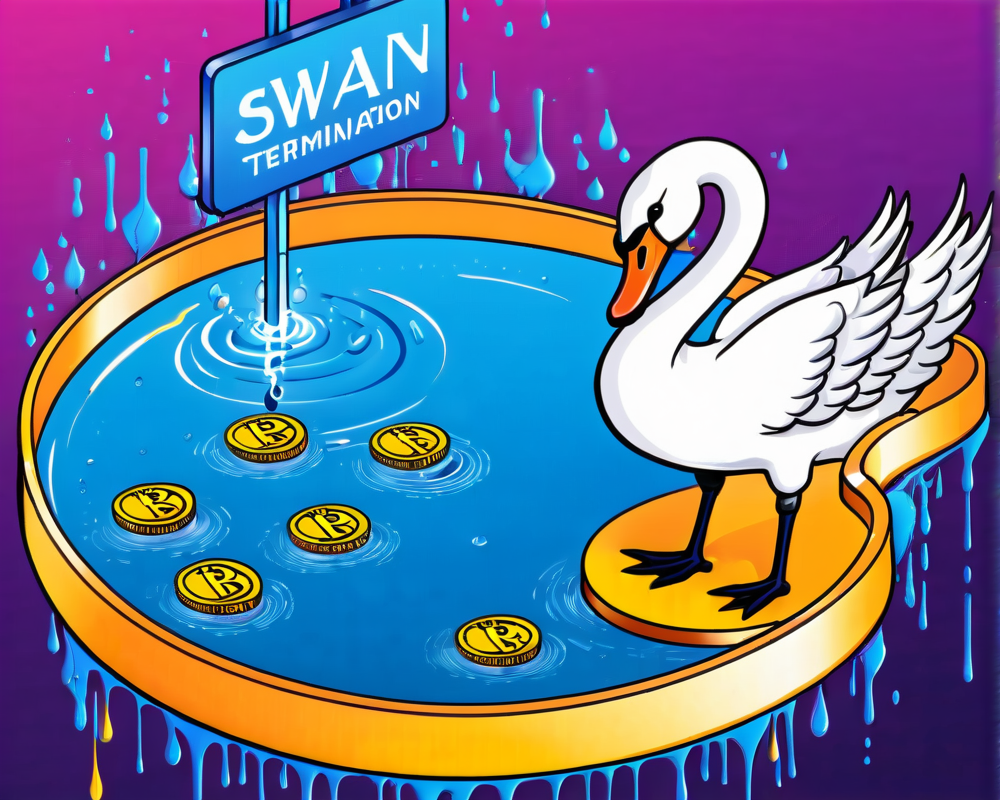

Swan Bitcoin recently made headlines by notifying its customers about a hardline policy concerning crypto-mixing services. In a world where Bitcoin transactions are often scrutinized more than a kid’s lunchroom choices, the platform expressed it must terminate accounts that engage in mixing activities. This arises from the tightening grip of regulatory obligations imposed by partner banks, suggesting a future where privacy is at odds with compliance.

FinCEN’s Shadow: Threat or Opportunity?

The memo from Swan Bitcoin pointedly draws attention to the U.S. Financial Crimes Enforcement Network (FinCEN) and its proposed rule, which seeks to expand the responsibilities of firms processing transactions from mixing services. Time to pull out that tin foil hat? Not quite. While some might see these regulations as conspiratorial, Pritzker’s letter refocuses the narrative on compliance, not censorship.

Why Mixing? The Misunderstood Service

Many are quick to paint mixing services as the dark horse of the crypto world. As Pritzker cleverly noted, mixing is akin to breaking down your Bitcoin pie into smaller, shareable slices—only ensuring some of the ingredients remain secret. Here’s a thought: it’s like hiding portions of your cash under the couch cushions rather than flaunting a wad at the store. Yet, just as nobody wants to admit they might hoard loose change, the industry finds itself in a precarious position.

The Political Climate: Fear and Foresight

The letter hinted at the palpable fear within the banking sector. In what seems like a political circus, most banks are shying away from anything crypto, making it challenging for firms like Swan to keep their Bitcoin off-ramp services afloat. Perhaps keeping a Bitcoin under the mattress could become the next trend? But not if FinCEN has anything to say about it!

Turning Fear into Education

Swan Bitcoin began to identify a silver lining. In their communication, they encouraged customers to arm themselves with knowledge—like equipping against a zombie apocalypse but in the realm of cryptocurrency. Understanding Bitcoin and its nuances is crucial in advocating for a balanced approach toward privacy rights and regulatory demands. Education is power, and it could very well be the sword in this potent battle between compliance and personal privacy.