Synquote Launches Innovative DeFi Options Platform with Social Logins and Undercollateralized Trading

Welcome to the Future of DeFi Trading

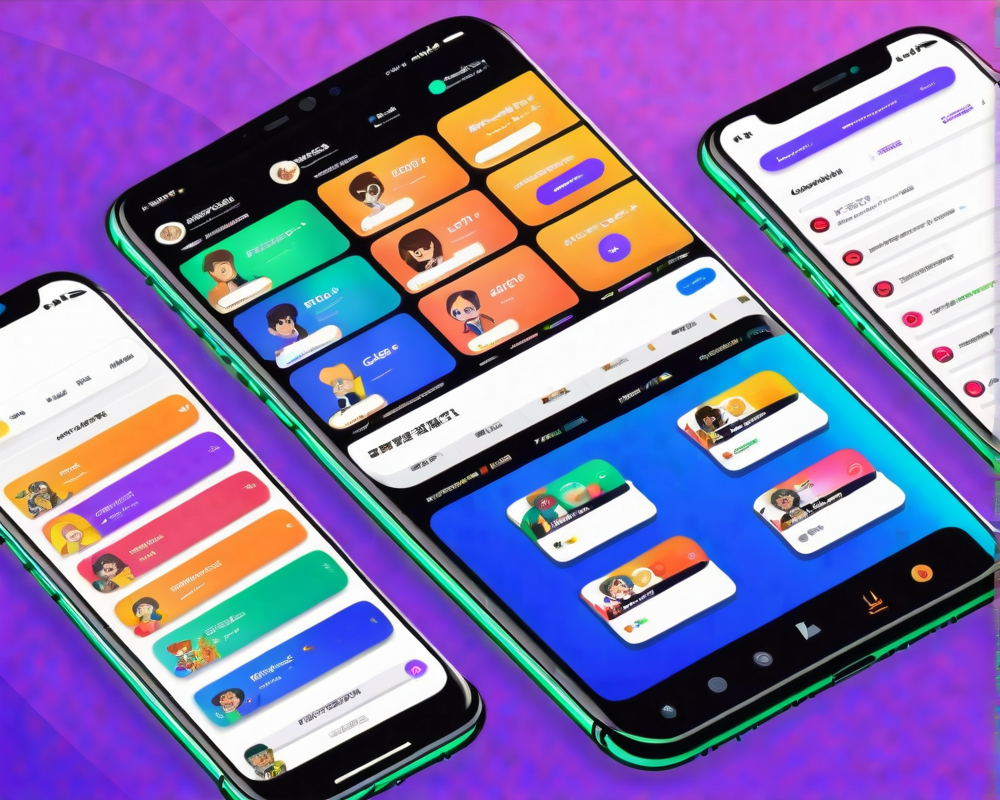

With a refreshing splash in the sometimes murky waters of decentralized finance, Synquote has officially launched its groundbreaking options platform. For all you traders out there who have been dreaming of a user-friendly interface and reduced slippage, this might be your moment to shine. The team behind Synquote claims they’ve mastered the art of big trades with less slippage—let’s see if they can walk the walk!

Beta Testing: Numbers That Matter

In its beta period, which kicked off on March 17, Synquote accomplished a notable feat, racking up over $25 million in notional trading volume. And wait for it—the crown jewel? A whopping $1 million trade executed without a hint of slippage. Yes, you read that right. That’s more impressive than my attempts at not burning toast!

A Game-Changer for Liquidity Providers

So what’s the magical secret sauce that Synquote is cooking up? For starters, it ditches the typical automated market maker (AMM) model for a more dynamic off-chain, peer-to-peer request-for-quote protocol. This jiggle allows greater flexibility in orders. Plus, liquidity providers can step into the arena with undercollateralized trades. You might be thinking, “What does that mean?” Think of it this way: you can now issue or sell options with just a fraction of the asset’s value. For instance, if you fancy selling a short-dated naked call, you might only need to cough up as little as one-tenth of the value in USDC. A real kicker, right?

Managing the Risks Like a Pro

But ease of trading doesn’t come without risks, as past experiences of undercollateralized platforms have shown, notably during market turbulence. Even the best can stumble, as seen with Vires.Finance’s infamous liquidity crisis. However, Synquote’s founder, Ahmed Attia, assures users that their risk management practices are as tight as a drum. They’ve conducted comprehensive backtesting with historical data, even amid the chaos of the FTX collapse, ensuring that their liquidation systems respond in a timely way. In essence, they’ve made it their mission to avoid any unwelcome surprises.

Logging In Made Easy

One notable enhancement that traders will rejoice over: social logins! That’s right, now you can access your trading account using your Google credentials. No need to download a wallet or endlessly take notes on seed words. Thanks to the brainy folks at Web3Auth, the barriers to entry just got a whole lot shorter, which could mean a spike in user enthusiasm!

Final Thoughts

As we witness the evolution of decentralized finance, Synquote stands out not merely for its technology but also for how it aims to reposition large institutions in this space. If all goes well and the risk management strategies keep those pesky crises at bay, Synquote could very well be a game-changer in the options trading landscape. So, strap in and get ready, because Synquote may just take you for a thrilling ride!