The New Gold Rush: Bitcoin and Altcoins

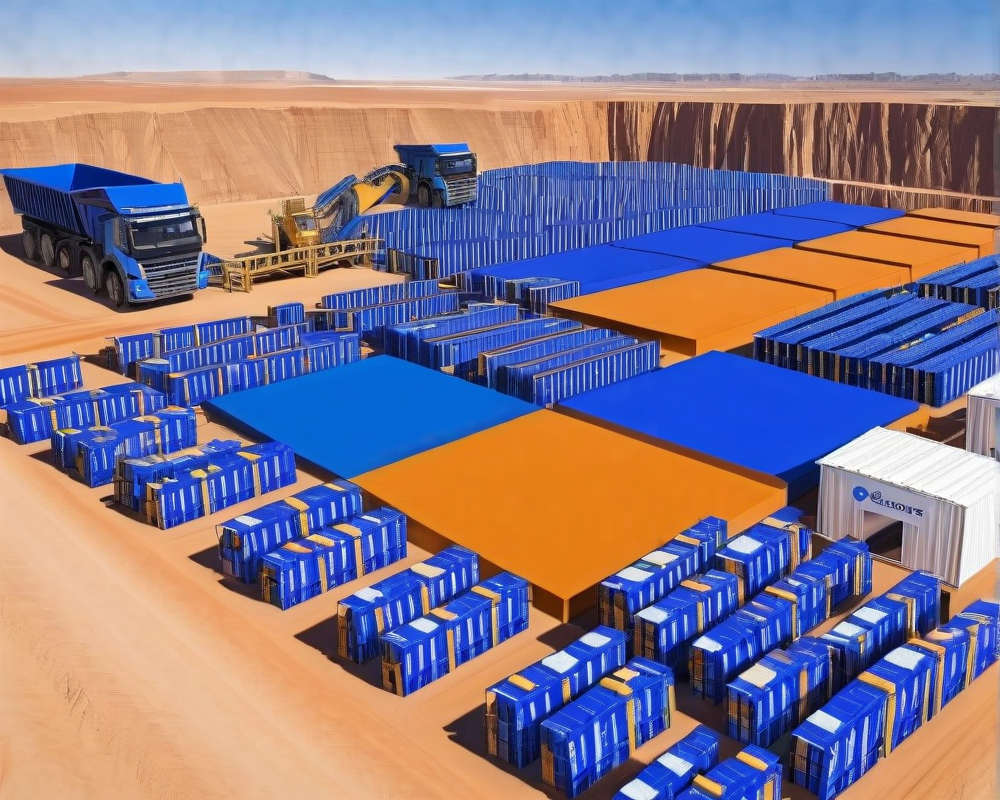

Today’s cryptocurrency landscape feels like a throwback to the wild west of the 1800s, where miners and dreamers risked it all in search of fortune. Instead of picks and shovels, we’ve got ASIC miners and complex algorithms, but the rush to find the next big thing remains the same. Like that epic gold rush, we’re seeing a variety of players, from gung-ho miners to savvy businesses hoping to profit from this digital treasure hunt.

Picks and Shovels: The Backbone of Crypto Success

Just as gold miners needed tools to dig, today’s crypto enthusiasts rely on technology to mine and trade. Melvin Petties shares insights on how industry players have pivoted to selling the “picks and shovels.” For example, companies that make mining rigs, offer cloud mining services, or develop blockchain technology are crucial. Yet, the path isn’t always paved with gold; many mining equipment providers between 2013-2015 found themselves in hot water, failing to deliver on their pre-sale promises.

The Dark Side of Mining Equipment

Petties highlights that most suppliers were like shady carnival barkers, promising the moon but delivering hardly a bag of rocks. Many claimed microchip shortages when in reality, they just couldn’t keep up with the demand or simply didn’t know what they were doing. Who knew that the tech world of Bitcoin had its own version of the villainous snake oil salesman?

The Wild West of Crypto

It wasn’t all glitter and gold, either; the crypto world hosted its share of scams. Cloud mining companies flooded the market, some offering tantalizingly good returns but often vanishing faster than a mirage in the desert. The “buyer beware” mentality left many crypto hopefuls feeling more like lost pioneers than conquerors of a new frontier.

Community Growth: From Gold Mines to Bitcoin Stores

Back during the gold rush, miners would strike it rich and invest their gains into building up their communities. Likewise, the peaks of Bitcoin’s popularity birthed countless businesses eager to cash in on the trend, leading to the rise of “me too” shops that gladly accepted Bitcoin as payment. Unfortunately, most of these ventures were little more than a passing fad, begging the question if anyone would find their pot of gold.

Financial Services: The Real Gold in the Crypto Mine

Not all that glitters is gold, though. Petties argues that the true winners from the crypto upheaval are the legitimate financial services emerging to support it. Smart exchanges are becoming the bedrock of this new gold rush, offering security and reliability that were sorely lacking in the chaotic early days. As he notes, this focus on safety is the path to integrating cryptocurrency into mainstream finance.

Encouraging Pioneers

He praises figures like the Winklevoss brothers for steering the ship toward safety and regulatory compliance. The evolution of crypto can be likened to that of early financial institutions establishing the way for a thriving economy; if we take care of security and regulations, the gold rush mentality might just turn into a sustainable economy.