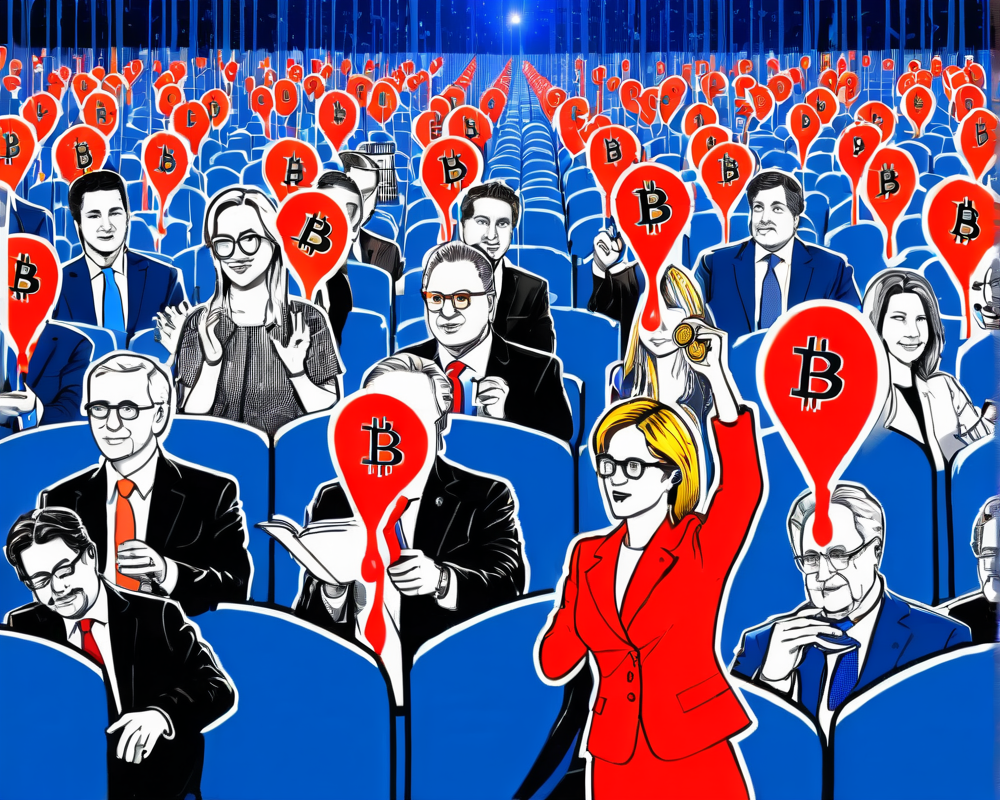

Setting the Stage for Crypto Regulation

The U.S. House of Representatives’ Financial Services Committee (FSC) is rolling out the red carpet for a notable hearing on November 15, aimed at dissecting the murky underbelly of the cryptocurrency landscape. Dubbed “Crypto crime in context: breaking down the illicit activity in digital assets,” this hearing isn’t just another day at the office; it’s a high-stakes party where prominent crypto entrepreneurs and regulatory experts will convene to shine a light on digital misdeeds.

Who’s Who Among the Witnesses

Expect an impressive lineup as the FSC invites crypto heavyweights to present their views. Bill Hughes, senior counsel at Consensys, and Jonathan Levin, co-founder of Chainalysis, are set to bring their industry expertise. They’ll be joined by Jane Khodarkovsky, a former federal officer with a laser-focus on human trafficking finance. Talk about a tag team of crypto knowledge!

The Committee’s Mission Unveiled

According to the FSC, their mission is clear: they aim to safeguard the digital asset ecosystem from exploitation by shady characters. The committee’s memorandum states, “To ensure that the digital asset ecosystem is not exploited by bad actors, it is critical that Congress understand the degree to which illicit activity exists.” This isn’t just fluff; they want to tackle real issues like money laundering and terror financing, which seem to be having a major resurgence.

Shedding Light on Illicit Activities

With a report from Chainalysis indicating that illicit cryptocurrency transactions reached dizzying highs in early 2023, it’s safe to say the FSC has their work cut out for them. The hearing will probe into the effectiveness of Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) measures employed by crypto exchanges and decentralized providers. If they don’t figure this out, it might soon be open season for illicit actors.

Regulatory Powerhouses in the Spotlight

The spotlight will also shine on major players like the Financial Crimes Enforcement Network (FinCEN), the Office of Foreign Assets Control (OFAC), and the Department of Justice (DOJ). Their roles in regulating this chaotic digital world are pivotal. With the DOJ planning to ramp up its crypto crime-fighting division (merging forces like some superhero movie), it’s clear the U.S. government is taking this challenge seriously.

The FSC’s proactive approach aims not just to clean house but also to lay down regulatory frameworks that can foster responsible innovation in the crypto scene. As they say, with great power comes great responsibility — and the FSC is ready to don its superhero cape!