Unpacking the Crypto Bill Confusion

The recent discussions surrounding India’s crypto bill have left many scratching their heads and even more tinkered with their wallets. A wave of panic selling swept through Indian investors as fears of a ban on private cryptocurrencies rapidly spread across the digital landscape. But hold on to your wallets!

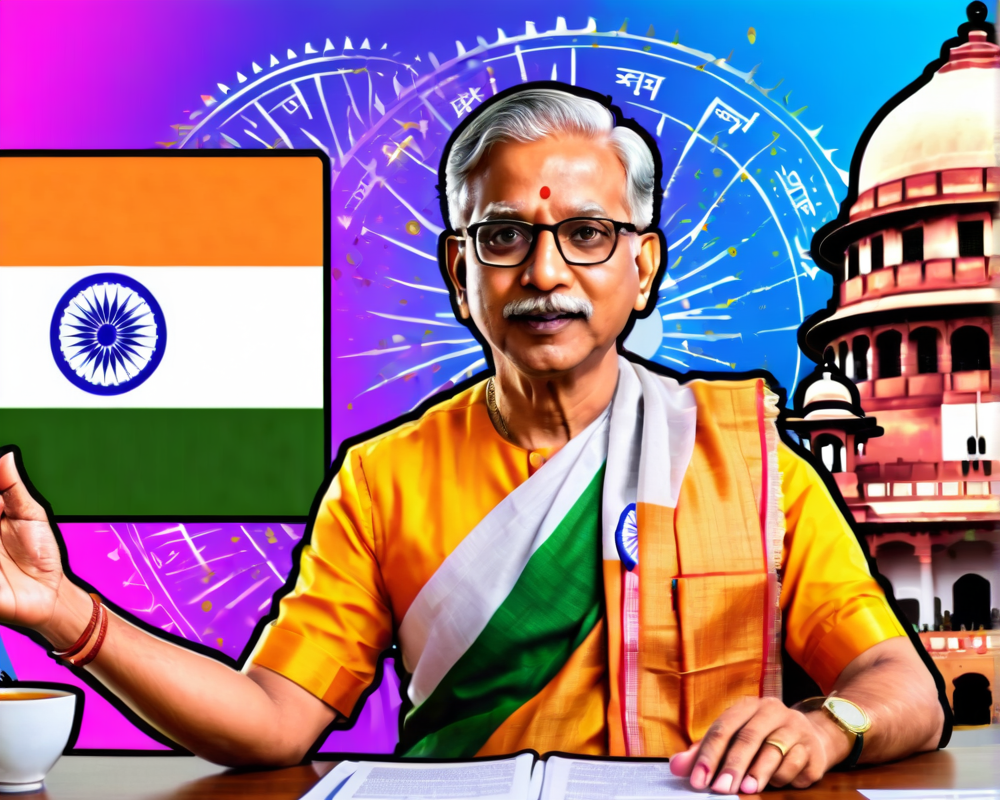

Subhash Garg Sets the Record Straight

Former Finance Secretary Subhash Garg stepped into the fray to clarify what he called a ‘misinterpretation’ regarding the proposed bill. In a candid chat with News 18, he emphasized,

“It is misleading to say that private cryptocurrencies will be banned and to intimate the government about the same.”

If only he had a dollar for every time someone misunderstood legal jargon!

The Dichotomy of Definitions

Ah, the fun of semantics! The crypto community is now grappling with two interpretations of the bill’s intentions. On one hand, there’s the version suggesting a blanket ban on all non-government issued cryptocurrencies. On the other, there’s hope that coins like Bitcoin (BTC) and Ether (ETH) will continue to operate unscathed on public blockchains.

What Is ‘Private’ Anyway?

Garg points out that the bill’s use of the term “private” lacked clarity. Without a concrete definition, it has led to confusion within the community. It’s like attending a party that doesn’t specify whether it’s a costume party or a black-tie affair—everyone shows up dressed for the wrong occasion.

The Asset Classification Quagmire

Another eyebrow-raising moment came when Garg challenged the idea of classifying cryptocurrencies solely as assets. He quipped,

“You don’t classify the wheat that you produce, you don’t classify the clothes you produce, as assets.”

There it is, folks—the feel-good analogy that reminds us not to reduce a complex ecosystem to merely ‘assets’.

High-Tech Frustrations Ahead

As if navigating cryptocurrencies wasn’t enough, Garg also raised concerns about the practicality of implementing a central bank digital currency (CBDC) in India. He noted that challenges like the lack of access to smartphones and digital wallets need to be addressed first. After all, how can you dive into the digital currency pool without a life jacket?

International Footprints in India’s Crypto Scene

On a lighter note, the Indian crypto market continues to catch international attention—like a popular new restaurant that everyone wants to check out. Singaporean crypto exchange Coinstore just allocated $20 million to set up offices in India. Much like Uncle Sam at a picnic, they’re hoping for a positive regulatory environment.

A Wish for Clear Guidelines

With the voice of the international firm echoing in the background, a spokesperson for Coinstore expressed optimism:

“Strict KYC processes, security requirements for exchanges, and gradual regulation would protect Indian users and clarify the legality of certain cryptocurrencies.”

Fingers crossed for some clear guidelines—and may the odds be ever in their favor!