The Rise of Alternative Investments

With personal savings soaring to unprecedented highs, Americans are now embracing riskier assets as a way to keep their money from stagnating. The COVID-19 pandemic has forced many to reevaluate where they park their cash, leading them to ditch the dollar for dynamic options such as stocks, gold, and, yes—you guessed it—Bitcoin.

Savings Rates in the Age of COVID

Thanks to prolonged lockdowns, individual savings rates have skyrocketed. But while a healthy savings account sounds nice, the reality is that interest rates have taken a nosedive, offering returns barely enough to buy a bag of chips at the corner store. Between these low yields and rising costs of living, who wouldn’t want to gamble a little in hopes of better returns?

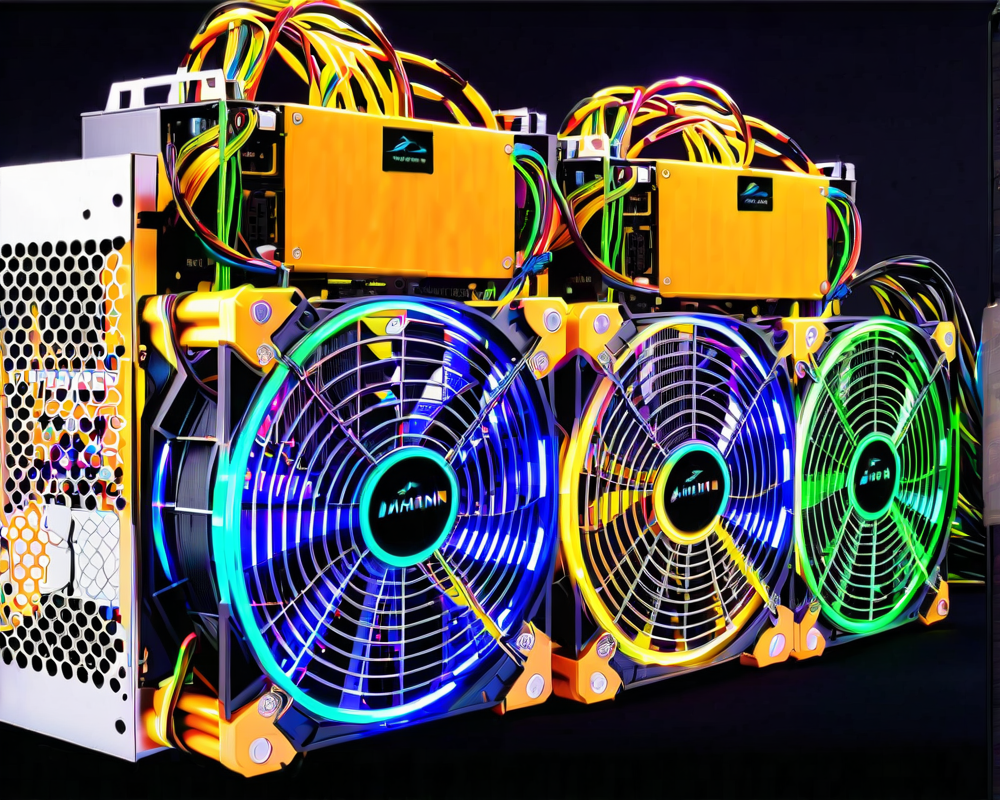

The Bitcoin Bet

Take, for instance, a 28-year-old Californian who’s decided to jump ship from his low-yield savings account, planning to turn his $15,000 into Bitcoin. In his mind, the potential rewards of cryptocurrency outweigh the perceived safety of cash, especially with long-term economic stagnation looming like a dark cloud. But before you start converting all your savings into digital coins, remember: with high returns comes the risk of steep losses. Will he emerge as a financial guru or a cautionary tale?

Dollar’s Rollercoaster Ride

The dollar’s performance has been anything but stellar lately. According to reports, July was not just any month but the worst month for USD in a decade. As the dollar dwindles in value against other world currencies, investors might find themselves in a tight pinch, prompting thoughts of escape through alternative assets.

The Stimulus Dilemma

As the nation braces for yet another round of stimulus checks—a safety net that, ironically, feels more like a band-aid—the fear of unchecked inflation looms large. More fiat may seem like a short-term boost, but inflation is knocking at the door, and it’s looking to crash the party. This could lead many Americans to hastily transition their hard-earned cash into higher-yielding investments, even if it means flirting with danger.

Final Thoughts: High Return, High Risk

Investing in speculative assets definitely comes with its share of excitement—and perhaps a dash of regret. As the greater economic landscape continues to swirl amidst a pandemic, investing will be a balancing act of risk versus reward. So, if you’re planning to toss your safety net for the circus of cryptocurrencies or the rollercoaster of stocks, just remember: in the world of investments, there’s truly no such thing as a free lunch.