Bank of Canada’s Digital Currency: Coming Soon or Just a Hasty Wish?

Deputy Governor Timothy Lane hints at a quicker rollout for Canada’s CBDC as cash transactions decline post-pandemic. What’s next for digital payments?

The Future of Ethereum: How Eth2 Will Transform Blockchain Transactions

Discover how Ethereum 2.0 is set to transform transactions and scalability in the blockchain world, according to ConsenSys’s Joseph Lubin.

Navigating the Challenges and Potential of Central Bank Digital Currencies

Explore the dynamics of CBDCs, their implications, and challenges posed by technology and geopolitics in the digital finance landscape.

The Digital Euro: A Journey Through the Hurdles of Central Bank Currency

Discover the challenges and future possibilities of the digital euro as European banks explore central bank digital currencies.

Breaking Down Project Aber: How Two Middle Eastern Economies Pioneered CBDC Innovation

Discover how Project Aber revolutionizes CBDCs, enhancing cross-border payments via innovative blockchain technology in the Middle East.

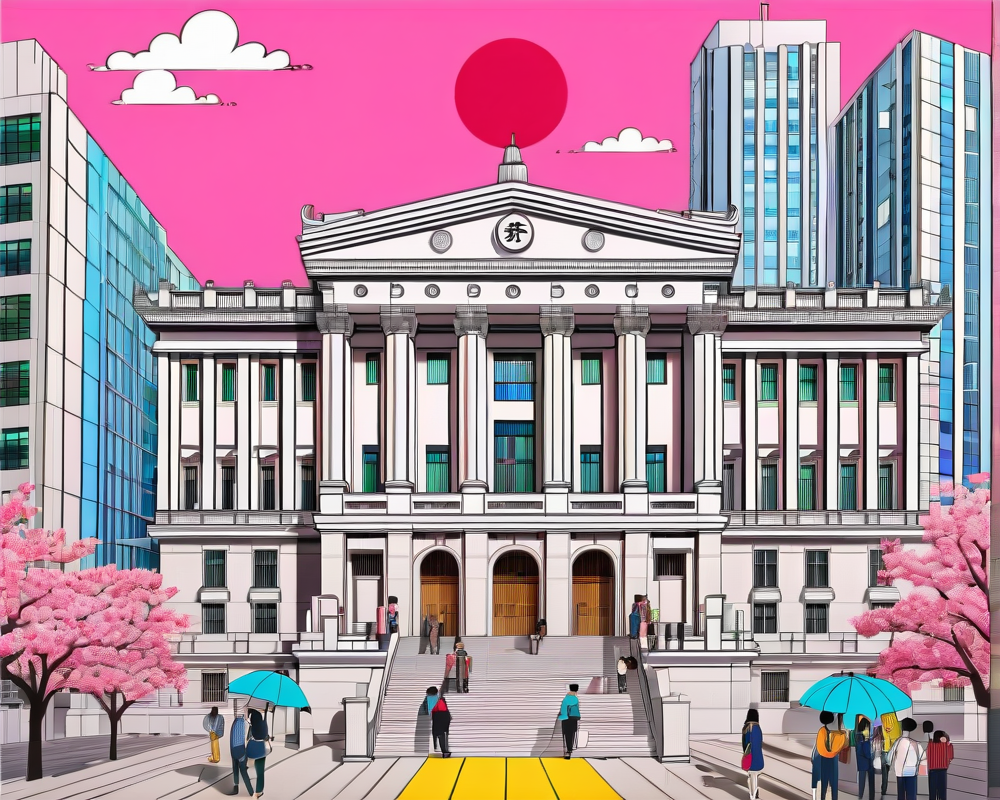

Bank of Japan’s CBDC Plans: A Digital Leap for Financial Services

Discover how the Bank of Japan’s CBDC plans aim to revolutionize Japan’s financial services and boost digital currency interoperability.

How Facebook’s Libra Sparks a Regulatory Revolution in Digital Currency

Explore how Facebook’s Libra ignites changes in digital currency regulation and the potential benefits of embedded supervision for stablecoins.

Ripple’s Journey Towards Central Bank Digital Currencies: A New Era of Financial Innovation

Ripple is hiring a senior director to engage with central banks on CBDC initiatives, redefining the future of digital payments.

The Rise of Central Bank Digital Currencies: A Solution to Payment Privacy Issues

Explore the potential of CBDCs as a solution for data privacy and efficiency in digital payments amid the decline of cash use.

The Rise of Digital Currency: How PayPal is Leading the Charge

Discover how PayPal is leading the digital currency revolution and what it means for the future of payments.