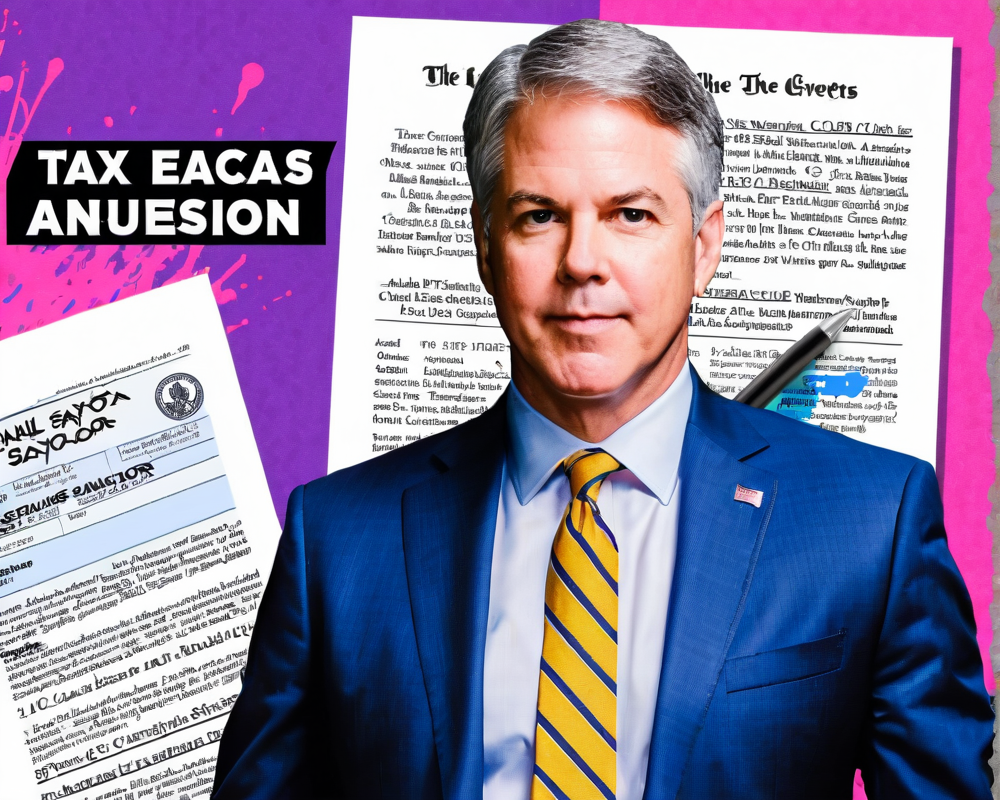

Tax Evasion Showdown: Karl Racine Takes On MicroStrategy and Michael Saylor

Attorney General Karl Racine sues MicroStrategy and Michael Saylor for tax evasion. Explore the legal drama behind this high-profile case.

Denmark’s Supreme Court Rules on Bitcoin Sales: Tax Implications in Focus

Discover Denmark’s Supreme Court rulings on Bitcoin sales and their tax implications for crypto investors.

D.C. Attorney General’s Lawsuit Against Michael Saylor: Tax Evasion Allegations Unfold

A deep dive into the D.C. lawsuit against Michael Saylor of MicroStrategy involving allegations of tax evasion and the unfolding legal drama.

Spain’s Tax Authority Targets 66,000 Cryptocurrency Holders Amid COVID-19 Crisis

Spain’s tax authority targets 66,000 crypto holders, reminding them of tax obligations during the pandemic. Stay informed to avoid surprises!

South Korea’s Cryptocurrency Tax Plans: A 20% Proposal and the Need for Clarity

South Korea proposes a 20% tax on cryptocurrency income amidst ongoing calls for clearer regulations in the digital asset market.

Understanding HMRC’s Cryptocurrency Tax Guidelines: A Deep Dive

Explore HMRC’s new cryptocurrency tax guidelines for individuals and businesses, covering capital gains tax, mining, and more.