What Did Goldfajn Say?

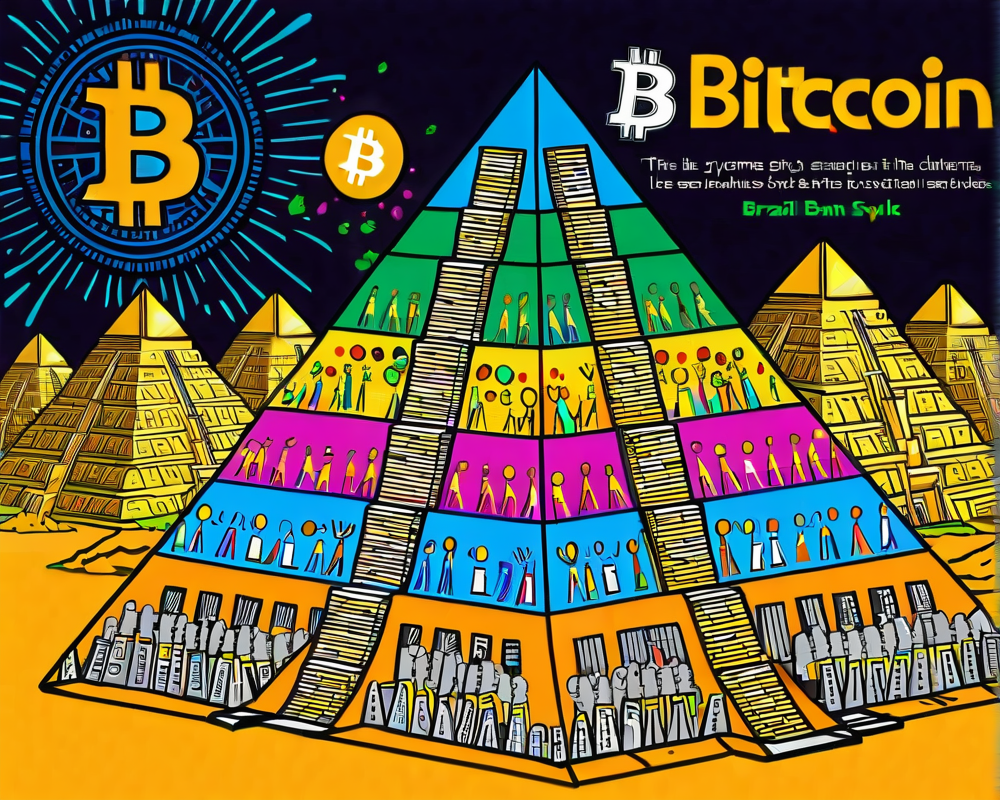

Brazilian central bank President Ilan Goldfajn recently stirred the pot by likening Bitcoin to a pyramid scheme. According to Goldfajn, investing in Bitcoin resembles chasing rainbows in a bubble where returns are inflated by hype rather than value. It’s almost as if he believes the only basis for Bitcoin is the guesswork of hopeful investors. Claiming that Bitcoin is a “financial asset with no ballast,” he implies that many are merely hoping to sell it to the next person at a higher price. If that’s not a soap bubble waiting to pop, I don’t know what is!

Pyramid Schemes: The Basics

So what exactly is a pyramid scheme? Picture this: an original investor roping in new victims who want to get rich quick—only to find that the money they promised isn’t coming from actual sales, but from the pockets of those new investors. Eventually, the scheme collapses as the pool of new investors dries up, leaving late entrants high and dry. They’re like the last ones to a party where the snacks have already been devoured.

Goldfajn’s Central Banking Stance

Goldfajn is adamant—the central bank has zero interest in monetary bubbles or shady dealings. In fact, Brazil’s central bank had already waved a caution flag back in 2014, warning citizens about the risks associated with virtual currencies. Talk about being ahead of the curve; they even released a research note exploring various potential applications of Blockchain technology while still keeping their distance from Bitcoin. It seems they want to have their cake and eat it too!

The Legislative Landscape

Meanwhile, Brazilian lawmakers are busy drafting rules for the use of digital currencies. Will Goldfajn’s comments shake things up? Only time will tell, but it’s like trying to predict which way a feather will float on a windy day. The comments from the central bank president could either fortify regulations or spark a rebellion among the crypto enthusiasts in Brazil.

In Conclusion: Bit of a Controversy

The comparison of Bitcoin to a pyramid scheme can be seen as both a wake-up call and a hatchet job. While some investors are definitely riding the roller coaster of speculative bliss, others are disconcerted by the unpredictability of digital currencies. Whether you view Bitcoin as revolutionary or a risky fad, the debate around it is far from over, making it a hot topic in both financial and legislative circles.