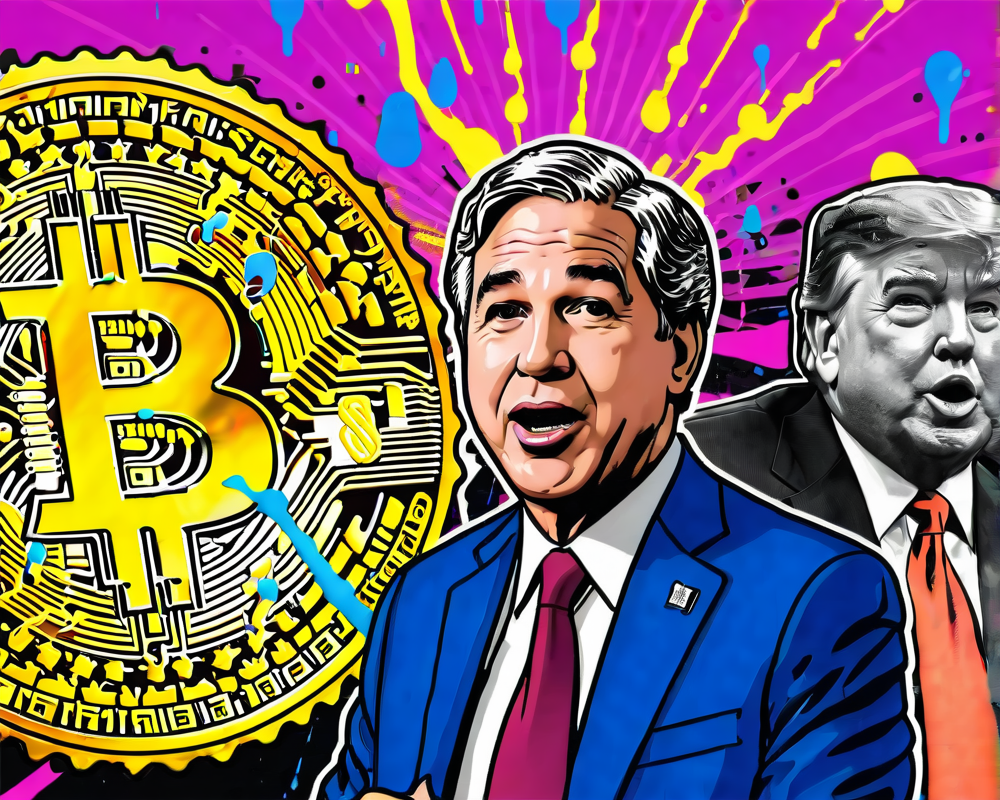

Goodfriend’s Controversial Views on Cash

Marvin Goodfriend, the new nominee to the Federal Reserve, has caused quite a stir with his anti-cash sentiments. You see, he believes that cash is like that overly generous friend who just can’t stop lending money—they’re great in a pinch, but a little too needy during a crisis.

The Fed’s Rate Lowering Dilemma

Traditionally, in tough times, the Fed lowers interest rates to breathe life into the economy. But picture this: If those rates drop below zero, folks might start making a run for the ATM to pull out their cash stash like it’s a zombie apocalypse. Goodfriend argues that this freedom to hoard cash undermines the Fed’s ability to wield its monetary magic.

Why Bitcoin Benefits from Goodfriend’s Policies

Should Goodfriend’s stringent policies come into play, the rise of Bitcoin might just be a happy coincidence. If people feel their cash reserves are at risk, they might flirt with the idea of investing in cryptocurrencies as a hedge. After all, Bitcoin is like that enigmatic character in movies—the lone wolf that operates independently of the establishment.

Critics Weigh In: The Good, The Bad, and The Confused

- Supporters: Call him a visionary, suggesting that his radical ideas could pave the way for innovative financial strategies.

- Critics: Label him the ‘worst Fed nominee of all time,’ warning that his policies could strangle the economy like a boa constrictor at a party.

Conclusion: A Friend to Bitcoin?

In the grand scheme of things, while other variables certainly contribute to Bitcoin’s price fluctuations, Goodfriend’s nomination may inadvertently cast a glow on the cryptocurrency market. In times of financial uncertainty, perhaps Bitcoin isn’t just an investment; it’s becoming a safety net, thanks in part to our overzealous friend over at the Fed.